Market Index

Official data shows continued market slowdown in December

New ONS data reiterates how the property market slowed at the end of 2022 - but December's average price decline was less dramatic than many expected.

London tenants cross the M25 in record numbers

Rental prices continue to escalate across the country, reports Hamptons.

Housing market continues to slow, with prices and transactions in decline – RICS

January's RICS UK Residential Survey show the most widespread property market decline since 2009.

‘Global prime residential rental markets were a bright spot in 2022’ – Savills

Prime rental values increased by an average of 5.9% across the 30 cities tracked in the Savills Prime Residential World Cities Index in 2022, while capital values increased by an average of 3.

‘Another clear sign that it will be a challenging year for the housing market’: Industry reactions to the latest BoE mortgage data

Prime property insiders offer their take on new Bank of England data, highlighting a steep drop-off in mortgage lending at the end of last year - featuring Savills, Knight Frank, SPF Private Clients and…

‘Slow burn’ start for mainstream market in 2023, as buyers hold back – Zoopla

Property portal expects a ‘cautious mood’ to continue in the housing market until Easter.

Tenant competition begins to ease as asking rents hit another record high

London rents are rising faster than in any other region, with the average asking rent in Inner London topping £3,000 pcm for the first time.

Agents report ‘noticeably less competition’ for development land

Major housebuilders have cut back on land buying in an effort to ride out the weaker sales market, says Savills, with some pausing activity altogether.

Official data shows ‘slightly weaker’ property sales market in December

Transaction volumes remain slightly above pre-pandemic levels, according to the latest (provisional) HMRC count.

London rents jumped 20% in 2022, and demand remains high

Demand for rental homes in London 'remains high and I do not see a great glut of stock on the horizon,' says Sarah Tonkinson of Foxtons.

Property market continues to cool – RICS

The latest RICS data on residential property deals, demand, new instructions and prices all point to a continued market slowdown.

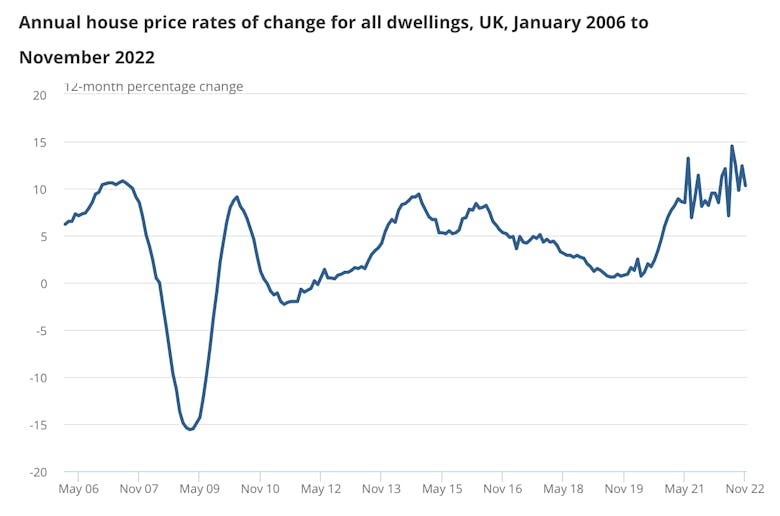

UK house prices dipped in November – official data

The average UK property price fell by 0.3% in November 2022, according to the official House Price Index, but London saw a 0.1% rise.