Market Index

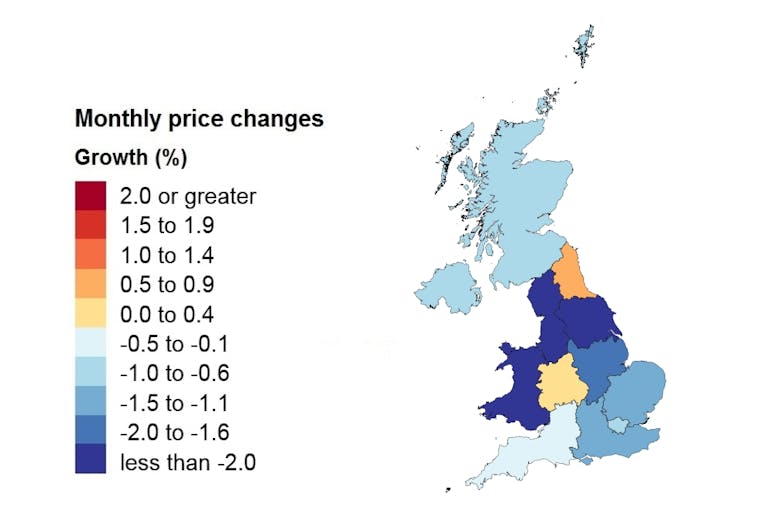

House prices dropped 1.1% in January – official data

The property market continued to cool in January, according to the latest UK House Price Index.

Estate agents report ‘robust’ sales market despite ‘doomy whispers’

Buyer demand is rising and stock levels are improving and transactions numbers are 'steady', according to the latest property market sit-rep from Propertymark.

Top-end home-buying activity sinks as asking prices get ‘over-optimistic’ – Rightmove

Property portal reports a sharp month-on-month increase in asking prices for "top-of-the-ladder" homes - despite dwindling buying activity in this market segment.

Prime global rental growth still in double figures – but the pace is slowing

'We expect prime investment markets to see robust activity in the short to medium-term,' says Knight Frank, as the pace of prime rental price growth eases in ten key cities.

Higher borrowing costs force a ‘change in strategy for landlords’

'Investors are having to dig deeper into their savings to ensure the sums stack up on any new buy-to-lets,' says Hamptons.

Property market shows signs of ‘a more stable picture’ – RICS

Key property market activity metrics all remain negative - but less so than in January.

Mortgage lending falls again as the housing market ‘suffers a prolonged hangover from the mini-Budget’

'There remains a huge amount of nervousness among borrowers, who aren't sure which way mortgage rates are likely to move next,' comments Knight Frank Finance on the latest BoE mortgage lending data.

‘Greater realism’ hits property sellers, as more under-asking offers accepted

A 'soft reset in house prices continues,' says Zoopla, as sales supply improves and vendors cut price expectations.

Rental supply is still ‘nowhere near enough to keep in line with high demand’

Propertymark has seen a slight improvement in the number of homes available to rent - but tenant demand still far exceeds supply.

Estate agents report sharp start-of-year jump in home-buying activity

Buyer demand jumped by 80% from December to January, reports Propertymark, while the number of agreed sales increased by 50%.

‘Bottleneck’ continues in London’s rental market as demand remains high and supply low

'Renters may need to change tactics in the coming year, setting aside more time for their property search and preparing to move fast when they see something they like,' says Foxtons.

Asking prices flatline as sellers show ‘unseasonal pricing restraint’

UK's biggest property portal reports "better than expected" start to the year.