Market Index

Asking prices nudge upwards as deal numbers recover

The property market is showing "unseasonal pricing restraint", says Rightmove as the average UK asking price rises by just 0.2% in the last month.

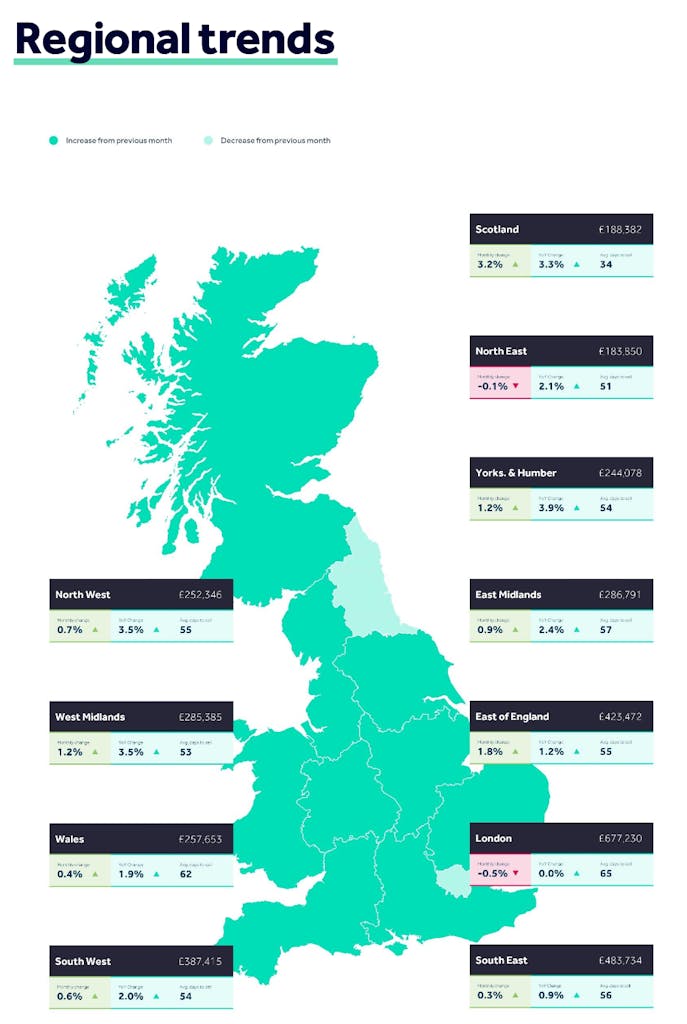

House prices & transaction volumes continue to fall – official data

Industry Reactions: Property insiders weigh-in on the latest UK HPI, which tells of another fall for property prices in February.

PCL sales tumble by a fifth – but ‘taking a longer-term view shows a different picture’

JLL's Prime Central London index for Q1 2023 tells of a 4.3% annual decline in achieved sold prices, and a 5.5% increase in achieved rents.

Retirees drive landlord sales as BtL demographics shift ‘irrespective of the tax or regulatory changes’

Hamptons estimates that around 140,000 landlords retired in 2022, accounting for nearly three-quarters (73%) of all landlord sales.

Property market ‘remains downbeat overall’ – RICS

Surveyors expect the weak sales market to continue for 'a while longer', before more stability returns.

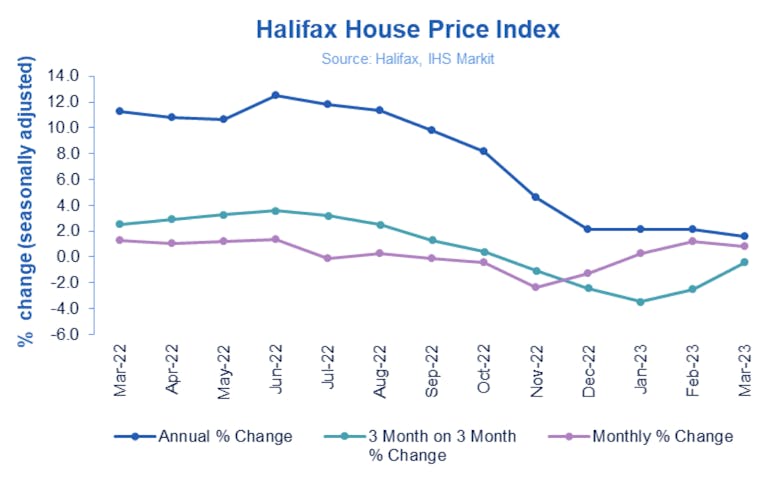

Industry reacts to the latest house price index, as prices rise again

Halifax's March data suggest a return to 'relative stability in the housing market'.

Housing market ‘defies expectations’ as transactions remain above pre-pandemic levels

Zoopla's latest data provide 'clear evidence buyers and sellers are striking deals at an increasing rate despite modest price reductions.'

Prime property price growth ‘stabilises’ across London and the country

'The gap between prime buyer and seller price expectations have widened,' warns Savills, as top-end house prices prove resilient.

Drop-off in PCL buyer demand is ‘a temporary dip’, says estate agency

London estate agency reports a fall in demand for both prime and super-prime homes in the capital through Q1.

‘The lettings market remains very much out of balance’ – Propertymark

Letting agencies report an average of ten tenants chasing each rental listing.

‘Confidence is growing’: Architects expect workloads to improve

RIBA's Future Trends Workload Index has returned to positive territory for the first time since July 2022.