Market Index

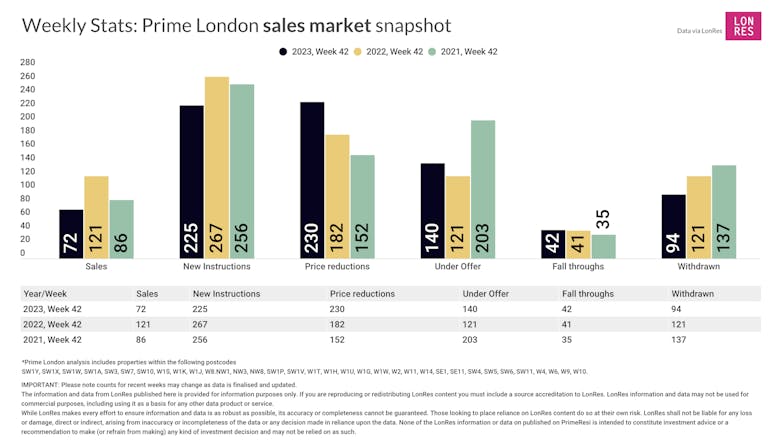

Prime London Property Market Snapshot: Week 42, 2023

41% fewer property sales were agreed in prime London last week compared to the same week in 2022, according to the latest PrimeResi Data Hub update.

‘The vast majority of properties are selling below the asking price’ – Propertymark

September data from estate agents 'points to a pricing correction despite average house prices continuing to rise'.

Property market continued to cool in August – UK HPI

There has been no change in the average house price in England over the last year, official data shows.

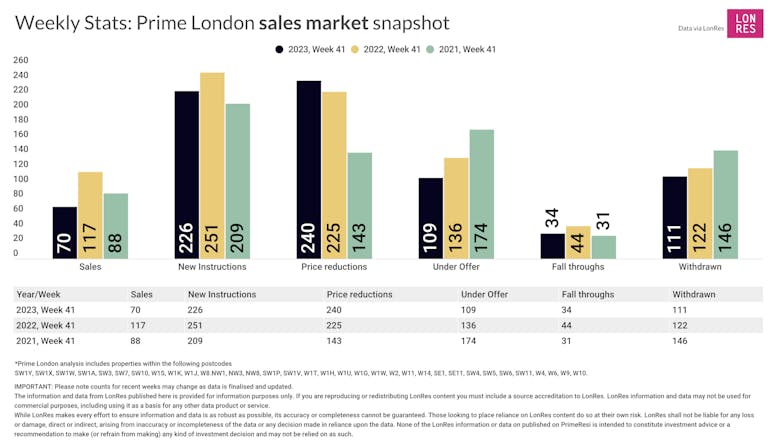

Prime London Property Market Snapshot: Week 41, 2023

Market metrics continue to point to a slowing market, with 18% fewer sales agreed in prime London so far this year compared to last, and 26% fewer than in 2021.

Prime London’s sales pipeline shrinks as demand drops off

The number of properties going under offer last month was down by over a quarter on last year's levels, which 'could impact on the outlook for the last three months of the year', warns LonRes.

Average prices still sliding across England & Wales, but pent-up demand ‘could be released in the coming months’ – new analysis

Market momentum could gather when interest rates begin to fall, suggests Acadata.

Rightmove reports lowest October asking price increase since 2008

Estate agents are telling the property portal that the sales market is 'the most price-sensitive ever'.

London rental market ‘begins to normalise’ as supply grows 10%

But 'we’re not back to a normal seasonal market just yet,' says Foxtons, as rental prices remain at records highs.

Higher-value homes bear the brunt of price declines in Edinburgh

Scottish city-centre flats are 'staging a comeback'. says Knight Frank.

Sales market is ‘stabilising’ despite ‘challenging backdrop’ – RICS

Surveyors expect property sales volumes to fall further in the next three months - but things should pick up within 12 months.

Prime London Property Market Snapshot: Week 40, 2023

Price cuts are proliferating in prime London's sales and rental markets, according to the latest LonRes intelligence.

Prime London rental growth eases to lowest rate in two years

The top-end of the lettings market 'is at a pivotal point', says Knight Frank.