Market Index

Prime buyer demand ‘creeps up’ in London

Almost one in five Rightmove listings priced between £2mn and £10mn had found a buyer in Q2.

Prime rental market ‘falls back to pre-pandemic patterns’

Rents are still rising in London and the regions, but Savills warns of 'misalignment' between tenant and landlord expectations.

RICS heralds ‘post-election bounce’ for housing market

Surveyors 'have confidence in the newly elected Labour government,' concludes the Royal Institute as housing market optimism builds.

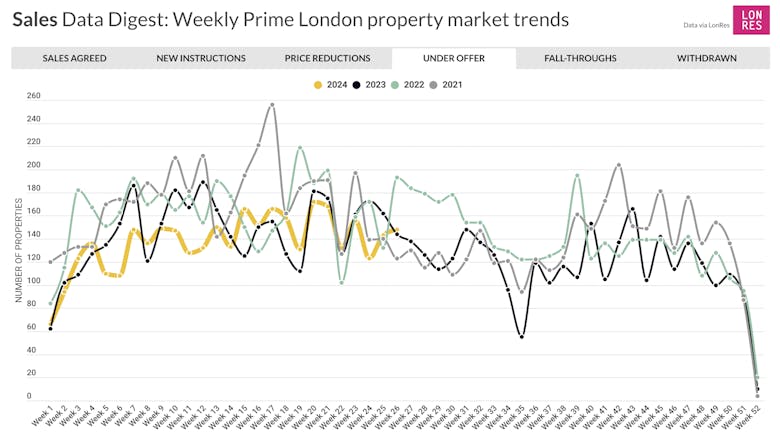

Prime London Property Market Snapshot: Week 27, 2024

The latest data suggest last week's General Election had little real effect on home-buying and selling activity across London's prime postcodes.

Global house price growth accelerates

82% of the 56 international property markets tracked by Knight Frank have seen property values rise in the last year.

Rightmove warns ‘120,000 rental homes needed for normal price growth’ as rents climb to another record high

Property portal calls for government interventions to help narrow the gap between rental supply and demand.

Prime London Property Market Snapshot: Week 26, 2024

While still quieter than in previous years, buying and selling activity in the capital's prime postcodes does not seem to have been massively affected by the imminent General Election.

Election build-up puts prime property price growth ‘on pause’, but buyer demand ‘remains resilient’

'Despite the short odds on a change in government and continued market activity, the general election has resulted in a degree of caution' in the property market, says Savills.

Mortgage lending drops, but remains higher than last year

Slightly fewer new mortgages were approved in May than in April, but substantially more than at the same time last year.

UK house prices are ‘currently 8% over-valued’ – Zoopla

Property prices are likely to morph from "over-valued" to "fair value" by the end of the year, says property portal, despite an anticipated 1.5% increase in average prices.

Prime London Property Market Snapshot: Week 25, 2024

Deal numbers have dwindled further in the capital's prime postcodes.

London’s rental market becomes ‘more balanced’ as supply rises – Foxtons

Rising supply relative to demand comes as 'a welcome relief to renters, landlords and agents alike', says estate agency.