Market Index

Prime London Property Market Snapshot: Week 50, 2024

An unseasonable jump in properties going under offer.

Rental price growth eases to a four-year low

'After an unprecedented four-year boom, rental growth for newly let properties has slowed to a crawl,' says Hamptons' research chief.

Sales market activity up despite the ‘usual seasonal lull’ – Rightmove

Asking prices dipped 1.7% in the last month, but buying activity 'remains strong' compared to last year.

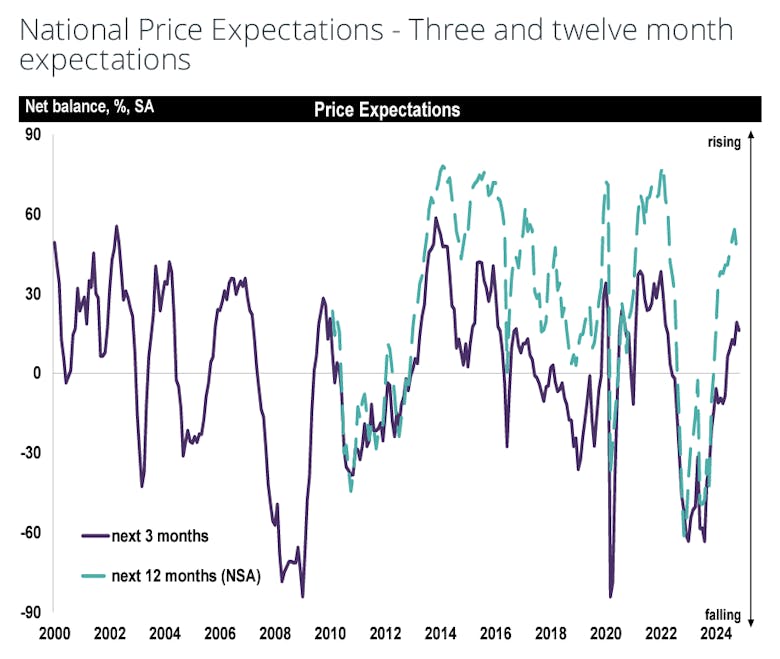

Property market outlook ‘remains relatively positive’ – RICS

Surveyors noted 'a steady improvement in buyer demand across the residential market' in November - but warn 'the broader macro environment is likely to pose additional headwinds moving forward.'

Rents climb at slowest pace in over three years

Zoopla predicts average rents will increase by another 4% through 2025.

Prime London Property Market Snapshot: Week 49, 2024

Deal numbers are falling sharply as the year comes to a close.

Viewing activity climbs as buyers look to beat Stamp Duty rise

'The sales market is set to see a trend unlike those historically seen across the winter months,' says Propertymark.

Prime London Property Market Snapshot: Week 48, 2024

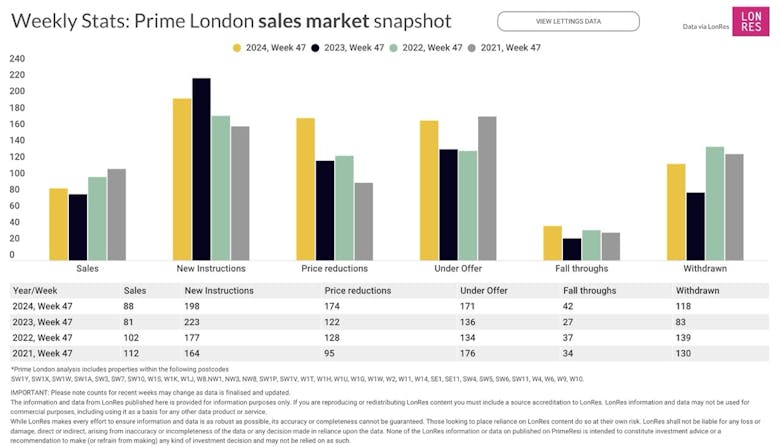

5% fewer sales were agreed across the capital's prime postcodes in Week 48 2024 than in Week 47, and 6% fewer than in the same seven day period last year

Mortgage approvals rose again in October – BoE

'The mortgage sector is set for an extremely busy end to 2024 and an explosive start to 2025,' declares Alexander Hall chief Richard Merrett, in response to the latest Bank of England data.

Transactions to climb as house prices ‘no longer over-valued’ – Zoopla

Property portal expects UK house prices to increase by 2.5% in 2025 and by 7.5% over the next three years.

Prime London Property Market Snapshot: Week 47, 2024

PrimeResi's weekly market sit-rep, featuring the latest sales and lettings data from LonRes.

Rent growth cools to below pre-Covid levels across key world cities

But 'the structural under-supply of new accommodation in major cities means rents are likely to rise faster than trend levels over the next few years,' says Knight Frank's research chief.