Market Index

Prime London Property Market Snapshot: Week 15, 2025

Stock is piling up in Prime London's property market, as agents list more homes for sale than are being bought.

Asking prices climb to record high despite stamp duty increase

Rightmove points to 'resilient activity' as the cost of buying a home jumps.

Demand for prime country houses slips 7%

'You can sell but only if you are prepared to be pragmatic,' advises James Cleland of Knight Frank, despite potential boosts to the market from sunnier weather & Trump's trade war.

Prime lettings market returns to growth

Savills had six prospective tenants for every London rental property on its books in March.

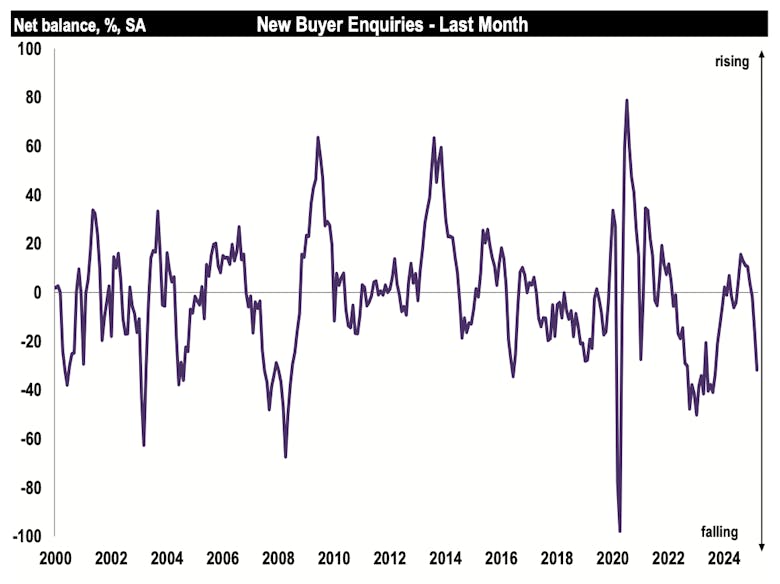

Stamp Duty deadline leaves property market ‘in a softer position’ – RICS

'The initial rush to complete sales before the April 1 deadline notably subdued towards the latter end of March,' report surveyors.

Prime London Property Market Snapshot: Week 14, 2025

New sales listings & price cuts abound in prime London.

Buyer demand dips but the market remains stronger than in previous years – Propertymark

'It’s likely that we will now see a return to a normal pace in the sales market now that the Stamp Duty threshold changes have taken effect,' says estate agency trade body.

Buyer demand dips in prime London

Richmond was the most 'in demand' area of the prime London property market in Q1, reports Benham and Reeves.

‘Modest growth’ for global house prices as markets ‘wait for rate cuts’

Knight Frank's index of property values in 55 international housing markets has fallen by 3.6% in real terms since 2022.

Prime London Property Market Snapshot: Week 13, 2025

50% more sales were agreed in prime London's postcodes last week compared to the same seven days last year, as price cuts continue to run rife.

Industry Reactions: Mortgage approvals slide again

'A minor slip in mortgage approvals in February adds weight to the narrative that the housing market recovery has lost some momentum,' says Lucian Cook of Savills

UK house price inflation climbs to 4.9%

Official data suggest property price growth has been steadily gathering pace since bottoming-out at the end of 2023.