Forecasts

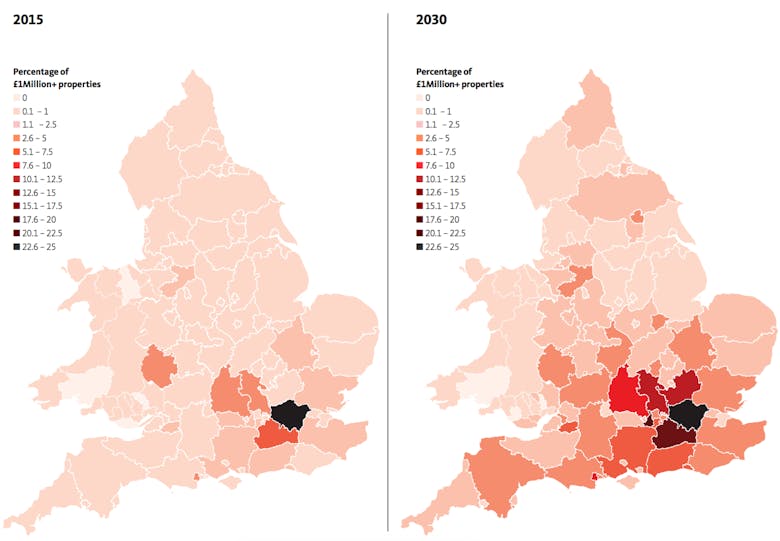

Number of £1m+ homes ‘to more than triple’ by 2030

The number of UK properties worth at least £1m is expected "to more than triple between now and 2030", says Santander Mortgages, rising from under 500,000 today to over 1.6 million in 15 years' time.

Crystal Balls 2016: Property market forecasts from the key residential research units

As another new year looms large, the residential industry’s leading pundits and analysts are unanimous about one thing: the property market is fragmenting, with micro-markets emerging in various locations…

Crystal Balls 2016: Prime property pundits’ predictions for the year ahead

It's been a tough 12 months for the high-value residential property industry, with a General Election cleaving the year in two, fallout from a major overhaul of the stamp duty system quashing activity,…

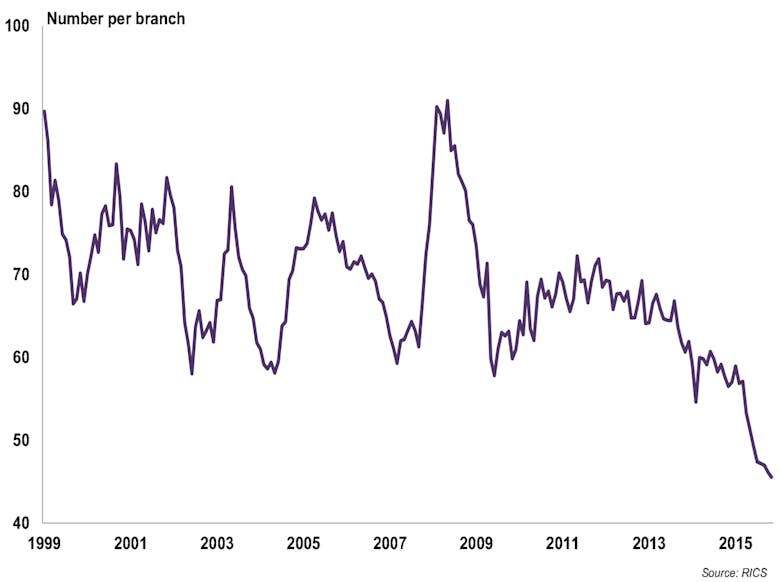

Short supply drives RICS’ 2016 house price forecast up to +6%

The Royal Institute of Chartered Surveyors has bumped its property price forecast for 2016 up from +4.5% in November to +6% in its latest housing update.

Prices to rise by 25% in five years as ‘no easing in supply constraint’ – RICS

UK House prices are expected to rise by 4.5% per annum over the next five years, delivering a cumulative increase of around 25% according to the latest from RICS.

RICS Forecasts

Property prices to rise by 20% over the next five years – Knight Frank

UK house prices will grow by 20.3% over the next five years, predicts Knight Frank, with prime central London bouncing back after a slow 2016 to deliver +20.

Periphery Vision: Inner commute areas to outperform as prime markets languish

The future looks pretty bright for property prices - as long as you're not banking on central London performance - says Savills in its big round of forecasts.

Steady five years ahead for the UK market; ‘uneasy’ PCL to rebound in 2018 – JLL

A strong and stable domestic economy will underpin the UK housing market over the next five years, says JLL in its latest batch of forecasts, while London looks set to come under increasing pressure.

No price growth for London’s top-end in 2016 – Savills

There is "little scope for significant value uplift next year" at the top of London's market, says Savills, as it casts an eye over what the coming five years may hold for property prices.

RICS doubles house price growth forecast for this year

The Royal Institute of Chartered Surveyors has amended its forecasts for this year to reflect higher price growth and lower transaction levels.

CEBR triples house price forecast to +4.7% this year, but London ‘weighed down’ by prime sector

The Centre for Economics and Business Research has significantly bumped up its house price growth forecasts for the second time in just three months, but London's price growth is being "weighed down" by…

OBR cuts 2020 house price forecasts by 5% – but the Budget won’t affect the market

The Office of Budget Responsibility has revised its medium-term forecasts for the property market down by 5% to +34.1% by Q1 2020, but not as a result of yesterday's Budget.

In real terms, that's a +13.