Compliance

Banning letting agent fees to tenants: Practical matters from the TPO

The Property Ombudsman responds to the government's consultation on banning letting agent fees paid by tenants

Government moots a public register of overseas companies with UK property

Thoughts wanted on a world-first "beneficial ownership register" for overseas companies which hold UK property assets

Investigation finds ‘less than a quarter of units’ at flagship London schemes sold to UK buyers

Transparency International analyses Land Registry records for 14 landmark developments

Unexplained Wealth Orders, Explained

A new law is making its way through parliament as part of the Criminal Finances Bill which will give the Serious Fraud Office, HMRC, the National Crime Agency and other agencies the power to requiring…

London is ‘a top destination for money launderers’, with no data on real owners of most foreign-firm owned property

Most foreign firms owning London property are registered in tax havens, say Transparency International and Reuters

Conveyancers deliver 12-point plan to improve the home moving process

43-page response to Government consultation calls for sweeping reforms to the system

Corruption crackdown could see ‘hundreds’ of UK properties seized

Unexplained Wealth Orders (UWOs) introduced as key component of the Government’s Criminal Finances Bill

New EU money laundering regulations for estate and letting agents open for consultation

Letting agents could get more due diligence duties

Why the new SDLT regime isn’t working

12% has crippled the South East, prevented inward investment (even with a cheaper pound) and is damaging businesses, says Charles Curran

Chelsea agent faces RICS expulsion over Channel 4 investigation

A full 15 months since 'From Russia With Cash' went out

End London’s ‘welcome mat’ for money launderers says Committee

The Home Affairs Committee has published its long-awaited report into money laundering today, in which it fingers the London property investment market for "making a safe haven for laundering the…

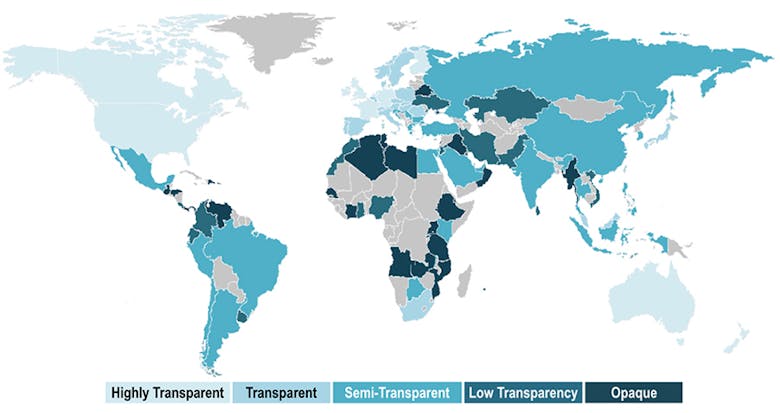

Ranked: The world’s most transparent real estate markets

A new report has ranked 109 of the world's real estate markets according to their transparency.