Location: United Kingdom

Marylebone property firms muck in to restore community garden

Some of Marylebone's top property firms joined forces last week to help restore a rundown community facility on Lisson Grove.

Vote Building: How is the election affecting London’s residential development market?

Central London's property market "is still busy below £1m but has quietened between £1.

Period Passivhaus: Grosvenor retrofits create London’s greenest period rental properties

Following up on its BREEAM Outstanding-rated retrofit in Belgravia, Grosvenor is bringing home even more from the sustainability front, retrofitting three rental properties in Mayfair and Belgravia…

97% more Londoners look to buy in Edinburgh

Property prices in Edinburgh rose by 1.2% between January and March 2015, to take annual growth to +4.1%, as buyers look to complete deals ahead of tomorrow's (1st April) tax changes, says Knight Frank.

Mayfair set to breach £6,000 psf this year as Indian investors drive the market up

NW8-based boutique agency Rescorp Residential has netted a £5,000 psf sale on South Audley Street W1, and predicts that Mayfair prices will breach £6,000 psf by the end of the year as Indian investors move…

Opportunity Knocking: ‘Act now’ if you want a great deal in prime central London

Those able to move quickly may get a property that will look very good value in just a few months, says buying agent Nathalie Hirst...

Full Frontal: HNW tenants pay £200k up-front in ‘frenzied’ PCL rental market

One in five new tenancies in prime central London is being let with six-to-12 months' rent - typically around the £200,000 mark (including deposit but excluding letting agent's fees) - being paid up-front,…

International consortium snaps up £1bn Bankside scheme

A £300m+ deal has just gone down on London's South Bank.

Luxury developer buys former Unite offices for £25m

The former offices of the trade union Unite in West London are to be turned into luxury flats.

Sales volumes slip; prices rise – Land Registry

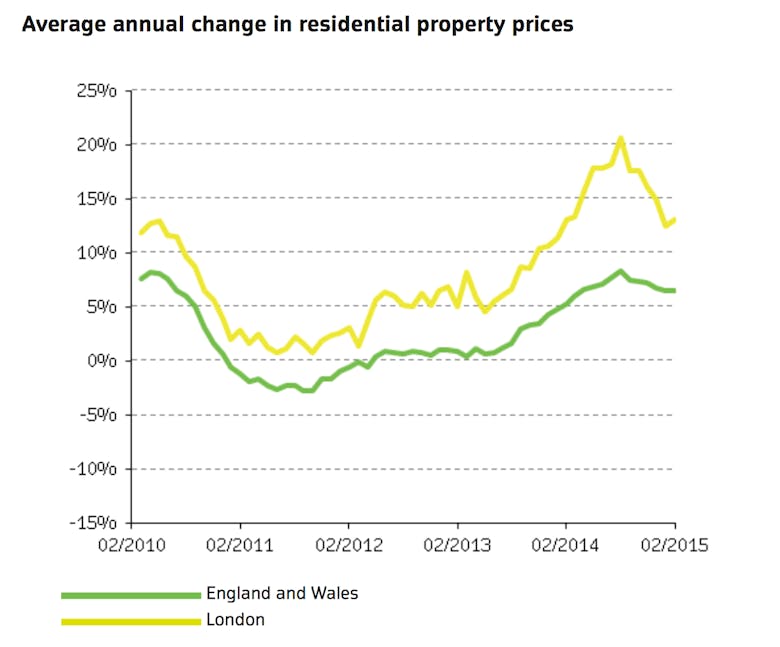

The number of £1m+ property sales has fallen by 4% compared to the same time last year - significantly less than the 11% drop in overall transactions - while average house prices have risen by 6.

£75m Off: £100m Bishops Avenue mansion ‘sells for knock-down £25m’

Heath Hall, dubbed "the most expensive house listed on the open market" when it came on for £100m back in 2011, has apparently just been sold for £25m.

A Man Of Property: How Thomas Cromwell became London’s first property developer

From a smithy cottage in the 'lawless' village of Putney to a portfolio stretching the length and breadth of the country, Amy Cole explains how the son of a blacksmith developed his way to a vast property empire…