Location: United Kingdom

Green light for Banda’s ‘statement’ scheme in Chelsea

The Royal Borough's planners have given their approval to Banda Property's very contemporary Haptic Architects-designed project on Rawlings Street and Rosemoor Street in the heart of the Chelsea Conservation…

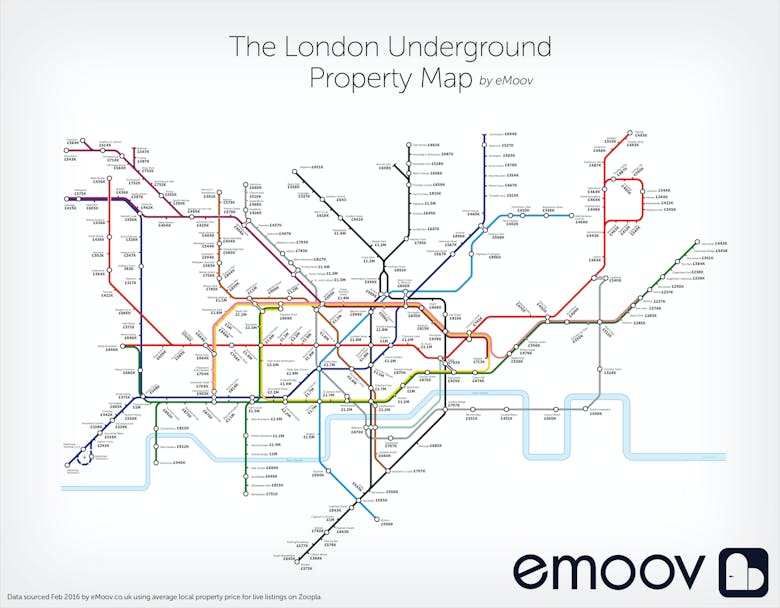

Mind The Gaps: London Underground Property Map 2016

Combining house prices and the tube is a surefire way to get capital-dwellers engaged, so canny old eMoov is onto a winner with its London Underground Property Map.

Countryside Properties shoots for a £1.1bn return to the stock market

Urban regeneration specialist developer Countryside Properties has put a £1.1bn price range on its looming IPO.

King's Park in Essex, by Countryside Properties

Private Property Search expands with two new recruits

Strutt & Parker's buying agency arm, Private Property Search, has been on something of a recruitment drive recently, bringing in two well-known prime London players to join the team.

50% of London new-builds should be affordable: Khan’s ‘firm new rules’

Labour's Mayoral candidate Sadiq Khan has laid out a pledge, backed-up with "firm new rules for developers", to make 50% of new homes built on public and brownfield land across London affordable.

Buy-To-Flop: Why these newfangled loans are behind the game

All this recent innovation in mortgage lending looks to be 'too little, too late', says Trevor Abrahmsohn...

If a Tree Falls in a Forest: The implications of Moorjani v Durban Estates

A recent judgment centring on 'whether inconvenience exists if there is no one present to experience it' will send reverberations right through the prime lettings sector, explains Rupert Higgins...

CZWG-designed show apartment unveiled at Islington Square

Sager Group and Cain Hoy have kicked off the sales push at their £400m Islington Square scheme by pulling back the curtains on the all-important show apartment.

Savills launches dedicated property service for ‘the professional sporting elite’

Savills is pitching its wares at wealthy sports stars around the world with a new dedicated team "which will offer a confidential property service to the professional sporting elite, who seek discretion,…

Scotland’s LBTT raises £34m less than predicted

Strutt & Parker has come out swinging against Scotland's Land & Building Transaction Tax, after the controversial new levy raised £34m less than predicted in the nine months to December.

Paddington’s controversial ‘skinny Shard’ to be downsized

It looks like Irvine Sellar and Westminster Council have caved to widespread opposition to Renzo Piano's design for a "skinny Shard" in W2, nicknamed the "Paddington Pole", making a call to "revise the…

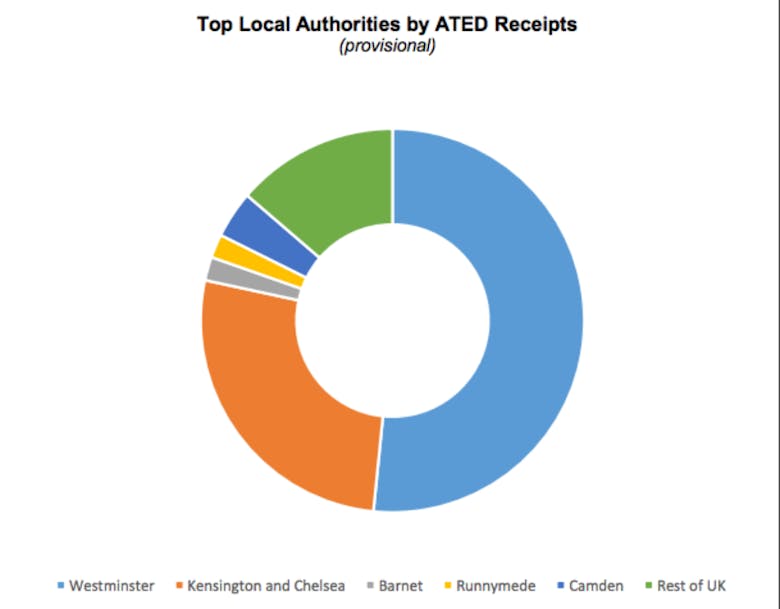

Westminster generating over half of UK ATED receipts

Annual Tax on Enveloped Dwellings (ATED) receipts were up £16m (16%) last year, with properties in Westminster generating over half the entire haul.