Location: Prime Central London

How to design a super-prime spa

If you are going to take the plunge and include a spa in your new scheme, make sure you thoroughly understand the target audience and do it properly, says Sheila McCusker...

A recent project in Belgravia

Demanding Times: Ten buyers chasing each property for sale – Countrywide

Demand is outstripping supply by a factor of ten, as an average of 9.7 buyers chased each property for sale in November, according to Countrywide.

That's up from 8.

Executive role for D&G’s Ed Mead

Douglas & Gordon's Ed Mead is taking on a new role as Executive Director of the agency.

Mead. D&G front man, FRICS, PrimeResi contributor

Empire Builders 1750-1950: The Brits Who Built the Modern World

Forming part of the "Brits Who Built the Modern World" season, this newish display at the V&A - the first part of a major exhibition organised by the Royal Institute of British Architects - is well worth…

Developing Market: 10% of Chelsea buyers are developers

International buyers accounted for 56.5% of Chelsea specialist Russell Simpson's sales last year, while nearly three quarters of new tenants were from overseas.

London’s £5m+ market climbs 24%, but under-performs the rest of prime

London's £5m+ market broke all the records for volume and value in 2013, says Savills, but price growth at the top of the top-end was slower than the capital's prime market's average, and per square foot…

Objects of Desire #2: Trophy property and the headless investment

The heart over-rules the head for many buyers of 'Billionaire Property' says Stephen Rees, Head of Real Estate Advisory at Coutts, in the second part of the bank's Objects of Desire report into passion…

Strong finish for D&G as December activity spiked

December kicked right off in Douglas & Gordon's patch, with a 50% increase in the number of properties hitting the market, a 20% jump in new buyer registrations and a 40% hike in the number of offers received.

Northacre appointed on super-prime scheme by Buckingham Palace

Northacre has been confirmed as the development manager on the much-anticipated 1 Palace Street scheme, right next to Buckingham Palace.

Under the terms of an agreement with Palace Revive Ltd.

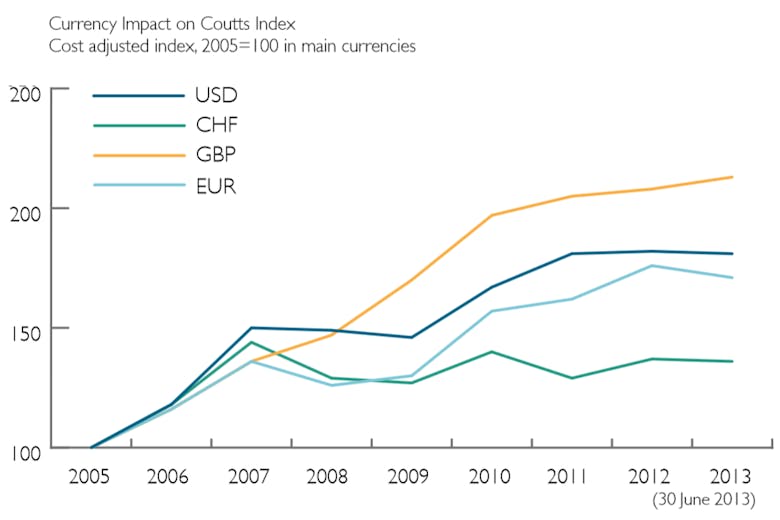

Objects of Desire #1: The driving forces behind passion investments

In the first part of Coutts' new Objects of Desire Index - which charts the returns on "passion investments" from trophy homes and classic cars to jewels and wine - Mohammad Kamal Syed, Head of Strategic…

The Pool on the Hill: John Lennon’s Surrey mansion up for £14m

John Lennon's old digs on the St George's Hill Estate in Weybridge, where he wrote much of the Sergeant Pepper's Lonely Hearts Club Band album, are up for sale for £13.75m with Knight Frank.

Public gets right to demand sale of government-owned property and land

New "Right to Contest" powers have officially come into force today, allowing the public to contest the use of central government land and property and apply for its release.