Location: Prime Central London

Golden Ticket: Prize Soho block goes for £43m

A key building on Soho's Golden Square has been snapped up by a resi developer for a cool £43.02m.

Prime Recce: A field guide to the nine neighbourhoods of Mayfair

Think you know Mayfair? Could you find the Artisan District? Ever viewed anything in Mayfair Town?

£2m+ buyers ‘are expecting a discount on last year’s prices’ – Savills

"The prime London market now looks fully taxed and buyers are slower to commit," says Savills' Lucian Cook, as the firm's quarterly review indicates a small drop in prime central London prices over the…

Thackeray Estate bags two planning nods and £40m worth of deals in heady summer

The Thackeray Estate had a pretty industrious summer by all accounts, bagging planning to transform two prominent sites in Chelsea and Southwark into top-end resi schemes, selling a boutique development…

Derwent completes luxury Fitzrovia scheme

Giant developer Derwent London has been putting the finishing touches to its new 15,500 square foot resi-led scheme in arty Fitzrovia.

London’s stamp duty burden breaches £3bn, but prime borough portions slip

London accounted for around 40% of the UK's total residential stamp duty receipts in 2014-15 - just over £3bn out of £7.

Bigger than the White House: UK developer unveils triple giga-mansion scheme in Bel Air

The Park Bel Air promises 'the finest living experience in the world'...

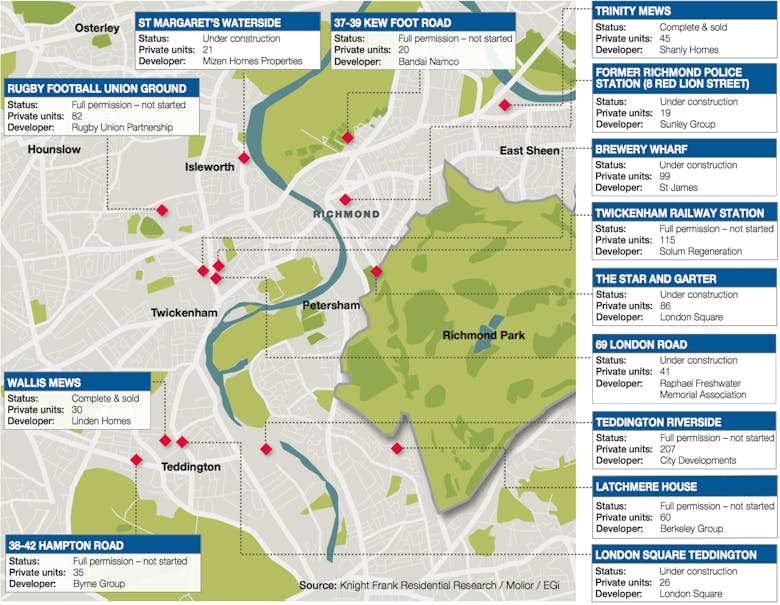

On Locations: Richmond’s ‘corridor of affluence’

The affluent enclave around Richmond Park and Village has a lot in common with the prime central London property market, with price performance moving in parallel over the last few years, says Knight…

Kate Moss moves into interior design for Yoo

Philippe Starck and John Hiscox' celeb-friendly design/development outfit Yoo has brought another A-lister into the fold, recruiting supermodel Kate Moss to design interiors for a £2.

First new Billionaires’ Row mansion in over a hundred years starts on site

Work has finally begun on the Colwyn Foulkes & Partners-designed residence at 3 Palace Green, the first new mansion to be built at Kensington Palace Gardens for over a century.

Criterion debuts ‘London’s most luxurious student digs’

A batch of newly-refurbished apartments in Mayfair have been launched as "London's ultimate student pads", with prices going all the way up to £21,000 per month.

Incredible live/work space of design pioneer asks £12m

The home and studio of global design hero Ross Lovegrove has just hit the market in Notting Hill.