Location: Prime Central London

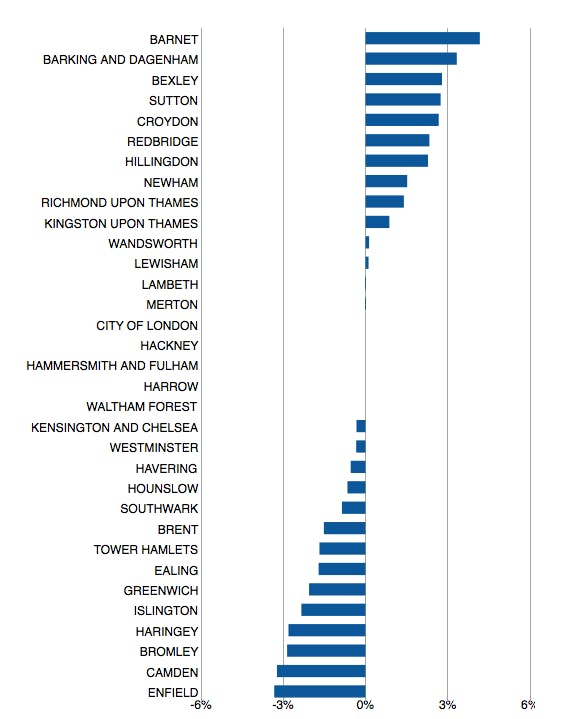

Game of Zones: Analysing the ‘regeneration uplift’ across London

A new study has unearthed some interesting stats on the wider impact of regeneration in the capital.

Asking prices cut on a third of Royal Borough instructions

A third of properties listed for sale in RBKC have had their asking price trimmed, with roughly 40% of homes on the market in Earl’s Court (SW5) having been subject to a price cut, and 35% of those…

New York has it right on property market transparency – Khan

Labour mayoral hopeful Sadiq Khan has called for New York-style transparency on all property transactions in London.

Don’t kill the golden goose with more tall building ‘mistakes’ – Historic England

Successful architecture is more than a collection of "iconic" objects that might "belong" as much in Dubai as in London, heritage champ Historic England has warned in a withering takedown of the capital's…

INTERVIEW: Katharine Pooley on design trends, discretion and Instagram

One of the UK's most in-demand interior designers

Candy & Candy hints at ‘a number of exciting planning commissions in London’

Nick Candy's luxury interior design and development business Candy & Candy Holdings Ltd has reported an operating loss of £500,676 after taking a hit on staff costs, but hinted at some "exciting" new…

‘Worrying signs’ in central London as development activity plateaus

Recent government tinkering will have the effect of actually slowing new development in central London, according to new predictions from JLL.

Strutt & Parker buying trio go it alone to launch new advisory

Three key members of Strutt & Parker's acquisitions arm Private Property Search have left the fold to set up their own buying consultancy.

Hugh Dixon, Deborah Walker & James Geddes

Opening Night: Shoreditch Stage breaks City launch sales records

Galliard's £750m resi development on the site of William Shakespeare's Curtain Theatre in Shoreditch - The Stage - has opened with a pretty rapturous first night performance, with £60m-worth of flats…

Keller Williams recruits in Mayfair to drive London expansion

Keller Williams UK, part of the US-based estate agency franchise megalith, has brought in a new face to its Mayfair hub to drive recruitment of more London agents.

Hamptons appoints new central London lettings boss

Hamptons International has appointed Boutaina Cansicka as its new Central London Regional Lettings Director.

Why the Panama Papers’ legacy of tax avoidance began with Blair & Brown

Morality aside, who can blame the world's super-rich from heading to London and taking advantage of legal tax efficiencies, asks William Cash