Location: London

MIPIM UK Awards: The finalists

MIPIM UK in London's Olympia, La Croisette's slightly less glamorous sibling, is coming up fast.

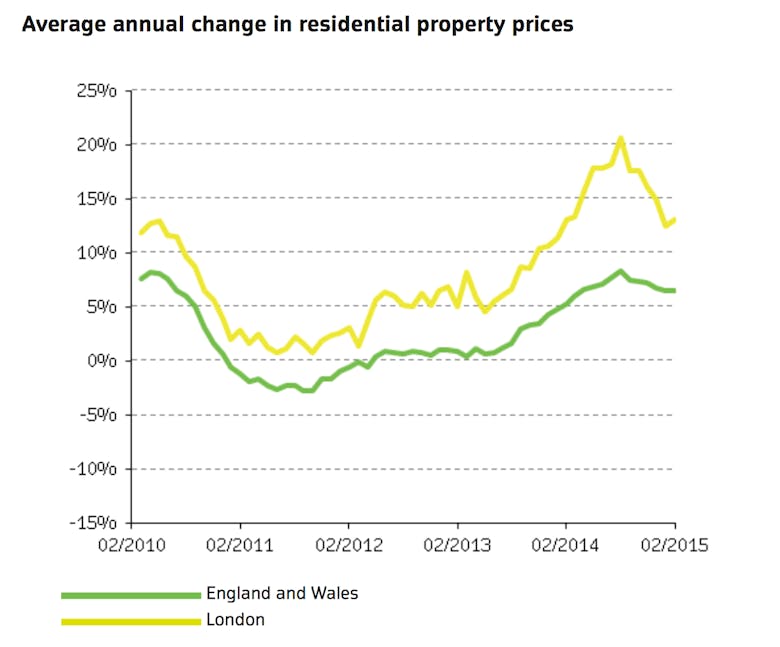

UK house prices carry on up – but not in Chelsea

House prices increased by 0.5% last month, taking the annual rise to +4.2% according to the latest from the Land Registry.

In London, prices rose by 1.7% in August, taking annual price growth to +6.6%.

Futureprime: Luxury trends in tomorrow’s residential development schemes

Understanding the lifestyle needs of wealthy international clients is a serious business.

Prime Property of the Week: Store Credit

Penthouse, Trevor Square, Knightsbridge £19m

Outside-Up: EcoWorld Ballymore goes totally tropical in Canary Wharf

EcoWorld Ballymore - the JV developer behind Nine Elms' "Sky Pool" - is continuing its outside-up theme in Canary Wharf, launching a 624-unit high-rise development where each apartments gets its own…

Grosvenor picks architects for 12-acre Bermondsey project

Grosvenor Britain & Ireland has settled on a team of architects to draw up development plans for 12 acres of Bermondsey.

Residential Land lands 122 apartments in west London

122 flats in a high-end Hammersmith mansion block have reportedly just changed hands for around £95m.

Hogwarts homes hit the market in Hertfordshire

Comer Homes has released 28 residential units in Hertfordshire's Royal Connaught Park, a former public school built in 1903 which may look familiar thanks to its appearances in nearly 400 films and TV…

British Luxury Awards: Nominees

The Walpole Group's announced the shortlists of its annual British Luxury Awards.

Here's who's up for what:

Best British Cultural & Creative Innovation

Mapped: The resi towers transforming London’s skyline

"Incredibly and suddenly London’s skyline is coming of age", says JLL in a new survey of the resi structures due to change the face of the capital.

‘Noticeable loss in confidence’ in private housing sector – RIBA

There's been a "noticeable loss in confidence" in the private housing sector amongst architects, says the RIBA in its latest member survey.

Hadid awarded RIBA’s Royal Gold Medal

Superstar architect Dame Zaha Hadid has added yet another trinket to her bulging trophy cabinet, winning this year's Royal Gold Medal for architecture.