Location: London

Election housebuilding stats, fact-checked

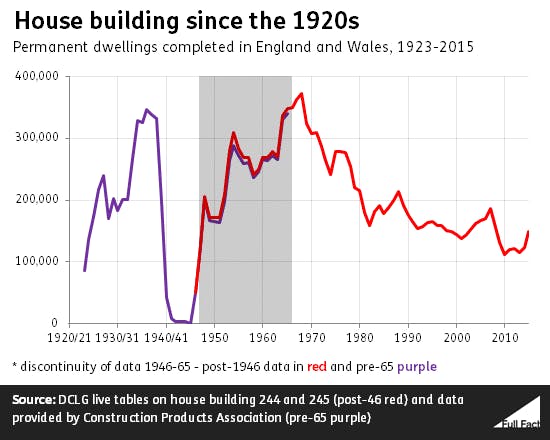

164,000 homes were completed in England in 2015/16. This is more than in recent years, but still below the 2007/08 pre-recession peak of 200,000

EcoWorld Ballymore launches 12 penthouses at Wardian London

Developer unveils a dozen top-end top-floor apartments with a botanical bent

Buyer snaps up £13m stunner on Chelsea Square

27-foot-wide freehold on one of London's biggest - and best - garden squares

Hill becomes UK’s third biggest private housebuilder after ‘exceptional’ year

Family-run firm saw turnover, profit and net worth rocket in 2016...

Super-prime deals still few and far between in London

Just nine £10m+ sales recorded across prime London during Q1, reports Turnbull Property

Fashion House to Penthouse: A guide to successful branding for luxury property developers

How London's top 20 prime resi development firms leverage their brands to secure interest and investment

Challenges mount for Battersea Power Station at ‘critical stage’

BPSDC reveals the harsh realities of delivering a £9bn scheme as rising costs hit profit forecast...

Window Shopping: ‘Pink’ Crittall’s Modern marvel goes up for sale

Grade II listed 1930s gem was built as the country residence of window wizard W.F. Crittall...

In Pictures: Historic canal-straddling Bath mansion offered for £3.5m

Grand Georgian office building has been converted into a lavish single residence by Trevor Osborne

Agency giants look to a digital future as revenues fall

Countrywide and LSL report 'anticipated' declines in Q1 as focus shifts to 'digital opportunities'

Cushman poaches resi research expert from Carter Jonas

Lee Layton joins London Markets team as C&W ramps up resi capability...

Two-house development opp in St John’s Wood up for £7m

Savills offers a plot with planning permission for a pair of luxury family houses in NW8