Location: London

PCL tenants lock-in for longer as rents continue to soar

The average length of tenancies in Prime Central London reached a new high of 25.8 months in Q2 2022, reports LCP, while the time taken to let a vacant property is at an eight-year low.

Weekly Showcase: Ten featured prime resi listings

PrimeResi’s regular stock check, powered by LonRes

Behind the Schemes: How an indoor/outdoor transformation ‘unlocked the true potential’ of a grand Belgravia townhouse

Inside the super-prime reinvention of a dilapidated Georgian gem, which had previously lain untouched for three decades…

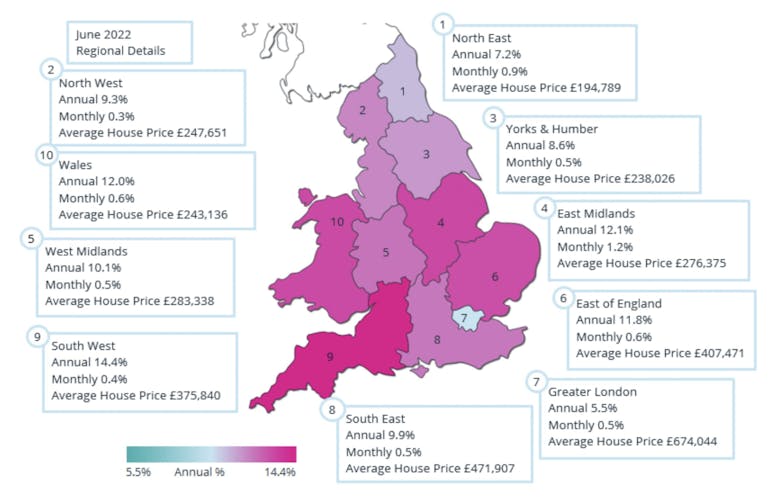

Heatmapped: Housing market continues to confound, as prices rise again

Annual price growth increased to 10.2% in England & Wales last month, reports Acadata.

‘Embrace the fear’: One year in the buying agency business, it’s been quite the journey

Emma Fildes of Brick Weaver reveals what it’s really like to start your own buying agency…

RBKC high streets protected by new planning rules

A planning order covering parts of Notting Hill, Chelsea & and South Ken has been given the green light by Levelling Up Secretary Greg Clark.

In Pictures: New boutique scheme unveiled in Kensington, with show flats designed by Finchatton & Matthews Rea

Developer Kolan has reworked a site on St Mary Abbott’s Place near Holland Park into five high-spec apartments.

Ranked: London’s most active property markets

Croydon (CR0), Wandsworth (SW18) and Merton (SW19) are the most active London areas for home-buying activity, with each postcode seeing more than 60 homes sold each month.

Deal sealed on original Academy Gardens show flat

4,146 sq ft duplex - which once served as the marketing unit for the luxury Kensington scheme - incorporates the building’s original library, now repurposed as a remarkable reception space.

‘Significant slowdown’ expected for prime London rents next year

Escalating costs of living and inflationary pressure are likely to slow the pace of prime rental price growth down in the coming months, says Savills - but the firm has still upgraded its five-year price…

Luxury fractional ownership firm inks deal with US brokerage The Agency; launches search for UK & Europe partner

Having signed up billion-dollar brokerage The Agency in the US, Sonhaus is now looking for a partner in the UK & Europe to help ‘transform the second home market’.

Fine & Country moves into Teddington

Elisard Malizi and team have taken on a second Fine & Country license in West London.