Location: London

House price growth slows – ONS

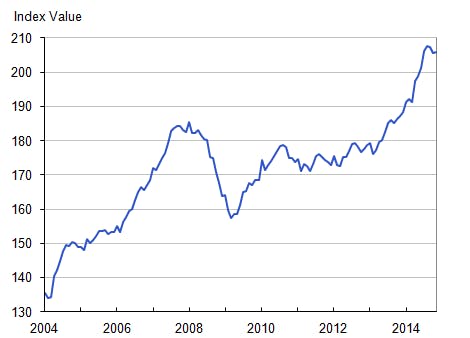

House prices across the UK went by an average of 10% in the year to November 2014, says the ONS, down a touch from October's +10.4% after just a 0.2% increase between October and November.

Finchatton strengthens senior team

Super-prime developer Finchatton has promoted Jiin Kim-Inoue to the role of Design Director, responsible for "leading and implementing the firm's global design strategy".

Jiin Kim-Inoue

‘Non-doms’ blamed for closure of Knightsbridge institution

Adding more fuel to the "lights-out London" debate, the owner of Knightsbridge restaurant Racine, which closed down last week, has laid the blame squarely on "non-doms" after reporting an exodus…

Royal Mail surplus sites valued at £1bn

City fund managers reckon the value of Royal Mail's portfolio of redundant sorting offices and sites has doubled in under two years.

Mount Pleasant sorting office

Royal Borough nudges listed building owners

Kensington & Chelsea council is "reminding" owners of the borough's listed buildings about their responsibilities, sending out a mailshot to all listed homes and launching a new web page .

Chestertons moves into Saudi Arabia with a ‘significant new investment’

Chestertons has amped up its Middle Eastern presence with a joint venture with Saudi-based MEDAD Valuation International (part of the Najeeb Abdullatif Alissa Holding Company).

Make appoints first female board member

Make, the architecture practice behind projects including St James's Market and Rathbone Square, has appointed its first female board member.

Foster + Partners’ Shoreditch skyscraper gets off to a flyer

Units at Principal Tower, London's first resi tower to be designed inside and out by Foster + Partners, have been selling like locally-sourced artisan hotcakes.

Style icon’s penthouse asks £6.95m

Is this the most fashionable apartment on the market right now?

UK developer strikes £300m deal to build English mansions in the Middle East

A British housebuilder has been signed up to deliver £300m worth of luxury resi across the Middle East, including a take on Kensington's super-prime Phillimores development.

HSBC injects £165m development facility to Barts Square

Helical Bar has secured a new £165m revolving credit facility for its Barts Square scheme in the City of London.

The moneys, provided by HSBC at an all-inclusive 3.

Carter Jonas boosts eastern region coverage with yet another acquisition

Another week, another new acquisition by Carter Jonas, this time in the shape of two Cambridge-based property firms.