Location: Americas

Could this be the straw that breaks the camel’s back?

Following the Labour party's surprise announcement that it would abolish the non-domiciled rules from April 2016, should it form the next Government, Amanda O’Keeffe asks whether this should be a serious…

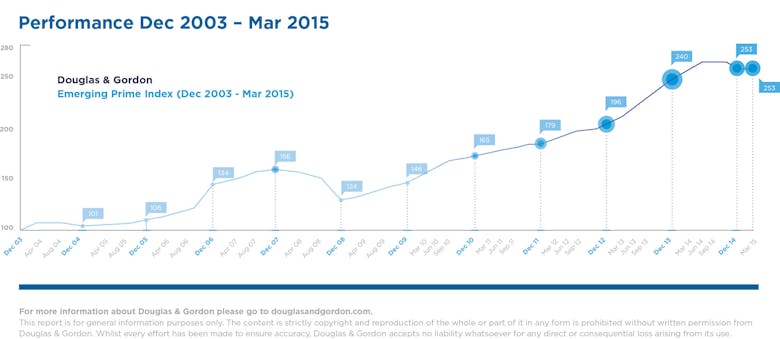

Clapham shines as emerging prime ‘proves robust’ ahead of election day

Today's Sloane Ranger Handbook would be more about the Northcote Road than the Kings Road, says Douglas & Gordon, as Clapham turns in a stellar Q1 and emerging prime areas outperform traditionally prime…

No More Rainy Days: Will the pension revolution boost ‘alternative’ property ownership?

As the UK's retirees begin the process of drawing down an estimated £5 billion from pension funds in the wake of the Government's landmark reforms, the next challenge is of course working out…

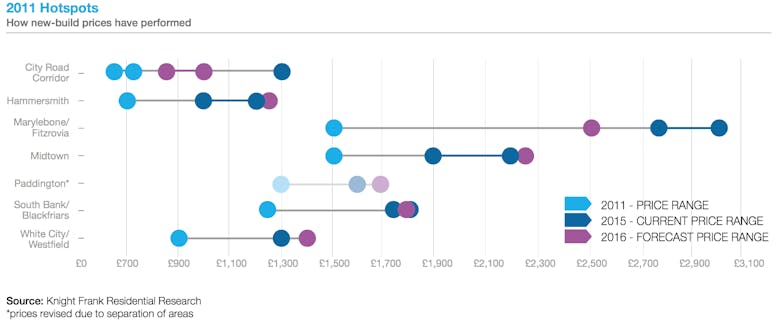

Capital Building: London’s future residential development hotspots

"The outlook for developers is not the same as it was in 2011," notes Knight Frank as it updates its list of the top areas for future residential development in London.

Chinese buyer splashes $70m in NYC’s biggest sale of 2015 so far

An unnamed Chinese buyer has shelled out $70m for an apartment at the Sherry Netherland building in New York. It's thought to be the highest price paid in the city so far this year.

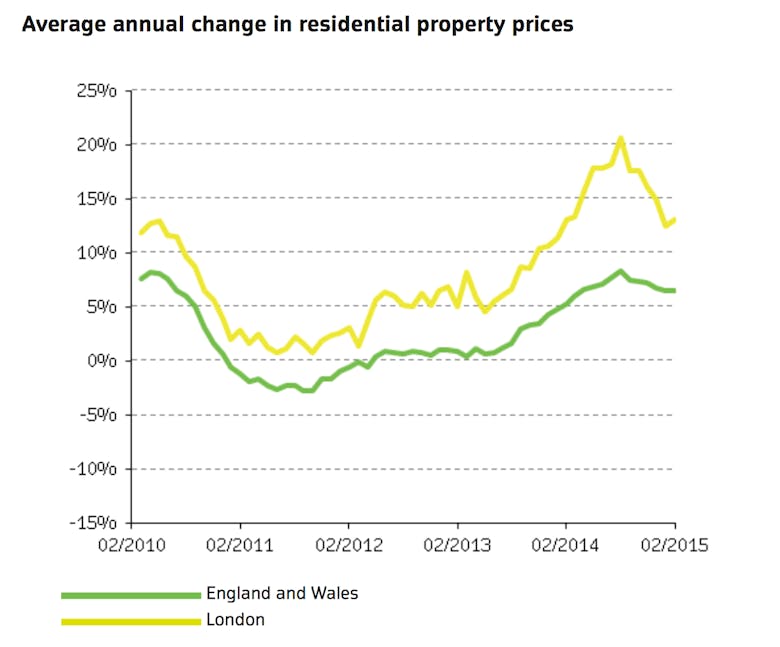

A two-speed recovery: Global housing markets since the Great Recession

The world's property markets have aligned themselves into two fairly distinct groups since the Great Recession, says the latest global housing update from the International Monetary Fund:

Sales volumes slip; prices rise – Land Registry

The number of £1m+ property sales has fallen by 4% compared to the same time last year - significantly less than the 11% drop in overall transactions - while average house prices have risen by 6.

London: Still the world’s most expensive city to locate employees but ‘beginning to look better value’

London overtook Hong Kong as "the most expensive world class city" in the middle of last year, and has, according to Savills, just retained its No.

Receding rate rise risk lures borrowers to variable deals

More mortgage borrowers are opting for variable rates that at any time since Nov 2012, as the chances of the Bank of England hiking interest rates anytime soon slips back.

INTERVIEW: Robert Soning of Londonewcastle on the art of developing

Londonewcastle chief on identifying potential, creating a legacy and staying in fashion

Budget 2015: ‘The sun is starting to shine and we are fixing the roof’

May's looking like a bit of an electoral stalemate according to most of the pollsters, so today's Budget was a splendid chance for the Chancellor to try to put some clear water between the Tories and…

#Budget2015: The prime property industry’s reactions

No surprises in today's pre-election Budget, and not much new that directly affects the top of the market, but there are still some things to have opinions about...

Read about what was announced here.