Latest Articles

Budget 2023: What’s in store for the property sector?

Jeremy Hunt's pre-Budget talking points emphasise 'the stability that comes from being responsible'.

Higher borrowing costs force a ‘change in strategy for landlords’

'Investors are having to dig deeper into their savings to ensure the sums stack up on any new buy-to-lets,' says Hamptons.

US firm buys UK property consultancy Gerald Eve

'Newmark’s backing will further strengthen our capability to operate at the top of our game,' says Gerald Eve boss.

Clear evidence of a sustained downturn but this is not a collapsing market – Acadata

Prices are still growing, albeit at a much-reduced rate.

Exclusive PrimeResi Member Offer: Essential AML knowledge for property professionals

Book Now: Invaluable anti-money laundering guidance for property and design professionals, from the experts at FCS Compliance, for free!

Interview: Jo Maudsley & Chris Pask of Charlton Brown on pushing the boundaries of luxury design in London

PrimeResi meets the duo behind one of London's most in-demand architecture and design firms to find out how tastes have been changing at the top-end of the market.

Last minute £22mn loan salvages west London development scheme

Developer nearly lost a £12mn deposit.

Sotheby’s to hold its first ever live real estate auction from New Bond Street

A selection of luxury properties will go under the hammer at the venerable London auction house in May.

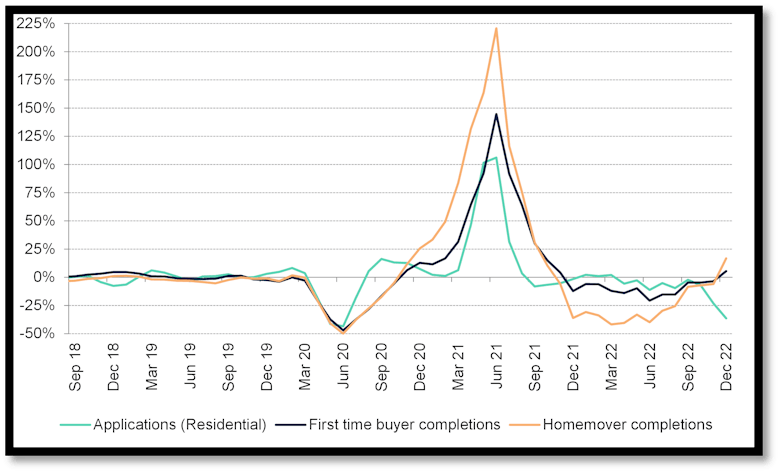

UK mortgage applications fell sharply in the final quarter of 2022

Fresh data from UK Finance and Accenture confirms the sharp drop in house-buying and consumer confidence following the ill-fated mini Budget.

Weekly Showcase: Ten featured prime resi listings

PrimeResi's regular stock check, powered by LonRes

Buyer shells out big bucks for ‘small slice’ of Sandbanks

Four-bed waterside bungalow on a 1.4 acre plot is now one of the most expensive pieces of real estate in the world.

Property sales listings have nearly doubled since the start of the year

New analysis points to a surge of new supply hitting the property market.