Format: News

Prime London buyers cast the net wider in search of value

The Buying Solution has picked up on an interesting and increasing trend in the prime London market - buyers appear to be casting their nets much wider these days.

Hong Kong, Luxembourg and Sydney named top favourable tax locations

Comparing lifestyle factors in 26 "favourable" tax locations around the world, a new report has picked out the best places to live depending on where you're at in life.

Waiting for the Dust to Settle: UK property markets and post-Brexit horizon lines

It's still too foggy to see the horizon, but the fundamentals that were true at the start of June will still be the fundamentals that are true at the start of July, says JLL's Adam Challis...

How have the world’s top resi markets been performing this year?

The latest instalment of Knight Frank’s Global Residential Cities Index, which tracks the performance of mainstream house prices across 150 cities, sees Shenzhen continuing to lead the world rankings…

Unreal Estate: Is this the best new-build house on the market right now?

An "unreal" contemporary mansion on Surrey's exclusive Wentworth Estate has become one of the biggest and most exciting open market instructions of 2016 so far.

‘We need better designed houses’ says the new Prime Minister

Theresa May picks up the keys to No.10 Downing Street this afternoon, completing the deal rather more quickly than expected.

UK brickmaker considers ‘temporarily mothballing’ two plants

A major UK brick manufacturer is considering halting production at two of its plants in response to "current economic uncertainty".

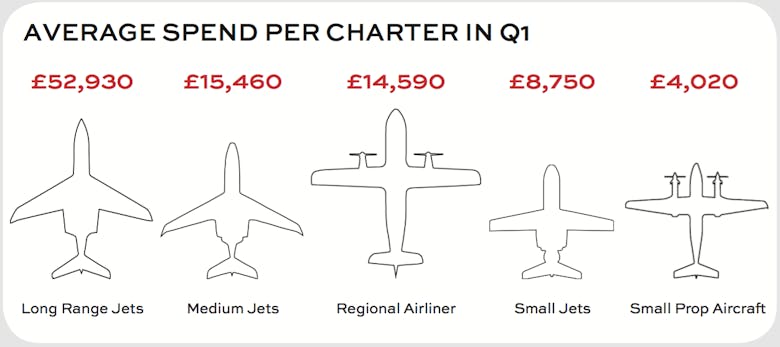

Fly Net Worth: Big rise in private jet charters to the UK

We've heard lots of anecdotal evidence suggesting an influx of overseas HNWs to these shores recently, but here's an interesting indicator: the number of private jets flying into London from Asia rocketed…

Grade I Cumberland Terrace mansion up for sale

The great John Nash saved arguably his finest work for Regent's Park, designing a series of neoclassical terraces that endure as some of London's most wanted residences nearly 200 years on.

Billionaires’ Row 2.0: Harrison Varma debuts ‘ground-breaking’ Buxmead scheme

Harrison Varma has lifted the lid on its landmark resi scheme on The Bishops Avenue in north London.

Developer given two years to rebuild pub ‘brick by brick’

A resi developer in north London has been given two years to rebuild a pub it demolished to make way for a new apartment scheme.

Strutt & Parker hires new National Head of Lettings

Strutt & Parker has appointed Kate Eales as its new National Head of Lettings.