Company Tag: SPF Private Clients

Industry Reactions: UK’s mainstream market shows resilience

Annual price growth softened last month, reports Nationwide, but insiders predict the 'shackles will come off' in January.

SPF moves into Dubai; plots further Middle East expansion

Marcus Hodges has been installed as Managing Director of SPF UAE.

Ranked: Areas with the biggest increases in cash-buying activity over the last decade

The number of cash property sales dropped by 27% from 2013 to 2023 across England, but some locations have seen sharp increases in the proportion of outright purchases compared to mortgaged buyers.

Sentiment improves as interest rates appear to be on the way down

Mike Boles, head of Private Office at SPF, discusses the outlook for interest rates and mortgage pricing as inflation falls.

New Hong Kong & Singapore offices for SPF

High-end mortgage broker has other new branches in the pipeline.

SPF returns to Edinburgh with new office

Mortgage broker's new office "is testament to the growing potential and attractiveness of Scotland’s property market."

Money matters: What next for mortgages?

After a turbulent few months, should borrowers act now or wait in the hope that rates continue to fall?

Mike Boles: What’s in store for high-value mortgages?

It's been a turbulent few weeks on the lending front: Mike Boles explains what this means for borrowers...

‘It could’ve been worse’: Property industry reactions to the Autumn Statement 2022

Chancellor Hunt has slashed CGT allowances, time-limited Kwarsi Kwarteng's Stamp Duty cuts, and subjected many more people to the top rate of Income Tax - but the run of tax increases come will come into…

Residential transactions jump in July

HMRC’s latest transaction data show a “remarkably strong” level of property market activity.

Mike Boles: Mortgage rates may be rising but borrowing remains attractive

As the cost of living rises at its fastest rate in 30 years and the Bank of England warns that inflation may hit 8 per cent, possibly higher, it’s unsurprising that interest rates are also edging upwards.

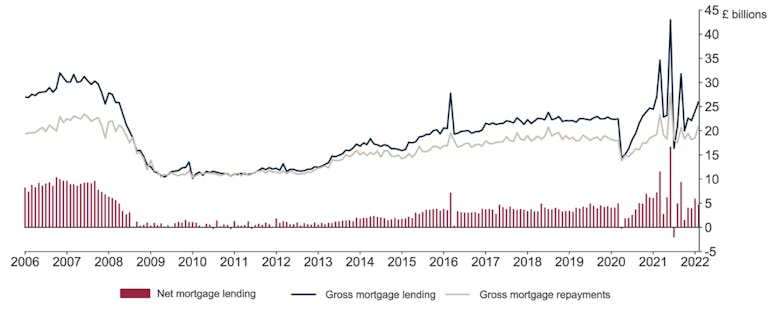

Mortgage lending drops, ‘confirming that the froth has come out of the market’

The average mortgage value was £235,474 in February - a significant 4.6% higher than the previous month, and 10.4% up one the year.