Company Tag: Oxford Economics

‘London may fit the definition of a Global City more than anywhere else in the world’ – Oxford Economics

Researchers have ranked 1,000 world cities across five categories, placing the UK capital in second place for the second year running.

Eurozone house price growth divergence set to ease, gradually

Oxford Economics thinks house price growth across Europe 'will become more homogeneous after sharp divergence in 2023.'

‘London offers the best outlook for residential real estate’ of any major European city, claim economists

'Fundamentals favour London as a residential opportunity,' says Oxford Economics.

Property price declines are ‘running out of steam’ in most major markets

Oxford Economics thinks 'further significant corrections are unlikely' for global house prices.

Economists predict ‘mild house price correction’ across Eurozone

European house prices fell again in Q1 2023, but at a slower pace than in Q4 2022.

‘More pain likely for global housing markets,’ warn economists

'The rapidity of recent price declines in economies like Sweden, Canada, New Zealand, and Australia suggests prices may retrace a large part of their previous boom,' says Adam Slater of Oxford Economics.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from TwentyCi, Zoopla, Savills, Oxford Economics & more…

Global housing downturn could see world GDP growth flatline, warn economists

The likelihood of a severe real estate slump is lower now than at the time of the Global Financial Crisis, but a significant drop in residential investment is 'plausible' next year, says Oxford Economics.

A house price crash ‘is looking increasingly likely’, warn economists

UK house prices are "overvalued by a third and likely to fall", suggests Oxford Economics, while Capital Economics boss Roger Bootle thinks we could be looking at a 10-15% drop in property values - equivalent…

UK housing market to cool after 2021 boom – Oxford Economics

"A soft landing is more likely than an abrupt correction" in house prices, says a top forecasting house.

Global real estate bounce ‘will extend into 2022’, predict economists

But Oxford Economics expects real estate returns to "temper considerably" by 2026, "falling well below their historical trend".

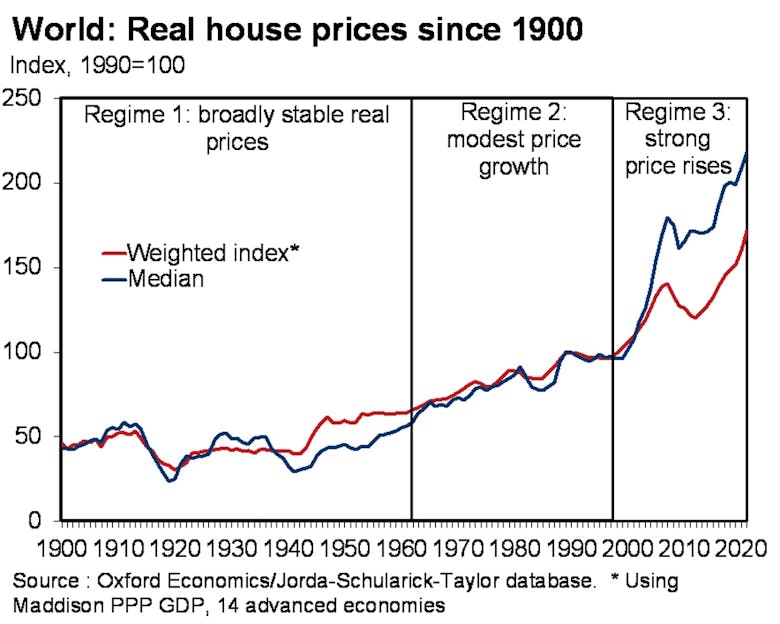

World house prices are ‘overvalued by around 10%’, warn economists

We're in one of the biggest global property booms since 1900, says Oxford Economics, as it warns that "the longer a housing boom continues, the bigger the risk of a large reversal".