Company Tag: London Central Portfolio

‘Bad news continues’ in Prime Central London

Prices and transactions down in a 'weak' start to 2019, reports London Central Portfolio; uncertainty in the capital has now 'permeated to the rest of the UK'

Stamp duty receipts slide by nearly £1bn

Last year's total of £8.55bn was a full £926m below the record £9.5bn collected in 2017, and marked the first decline in three years

PCL prices and sales plummeted at the end of last year

Fewer than than 68 deals per week went through in Prime Central London during 2018, reports London Central Portfolio, while annual transactions across England & Wales fell by 3.

Market woes hit PCL property fund

London Central Portfolio Property Fund sees net asset value fall by nearly 20% as political uncertainty and tax changes eventually take their toll;

Prices & transactions continue to suffer but there is a ‘significant weight of capital poised to make its move’

Several instances of competitive bidding could be the first sign of a long-awaited bounce-back, says LCP

Q3’s transaction tally was 4% lower than last year – and nearly 9% lower than in 2015

“HMRC Stamp Duty statistics do not paint a rosy picture of the UK housing market," says London Central Portfolio's Naomi Heaton, "with neither the buyer nor the Exchequer winning out"

PCL deal numbers sink to a paltry 70 per week

Transaction volumes in the most expensive postcodes are now running at below the levels seen during the Global Financial Crisis, according to LCP;

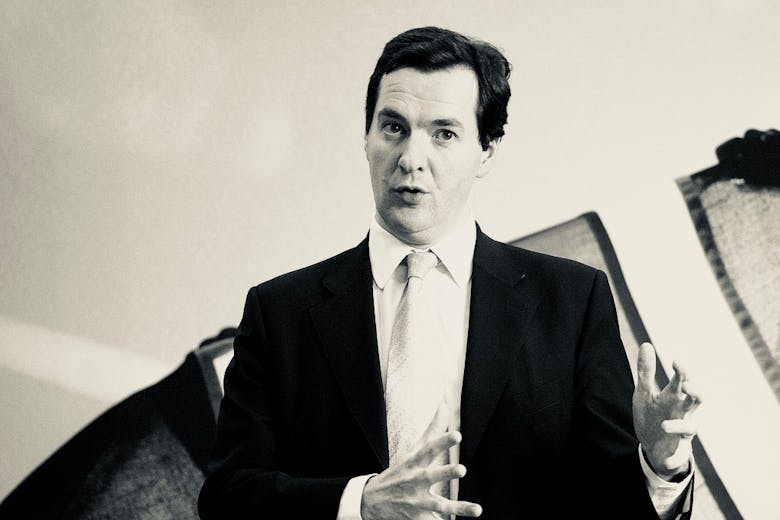

How George Osborne ‘wrought havoc’ on the resi property market

Ahead of Spreadsheet Phil's big day, London Central Portfolio collates the latest SDLT statistics to argue why the government's recent programme of tax reforms has been both 'ill-conceived and ineffective',…

PCL deal drought continues as transactions sink to ‘all-time low’

Just 3,606 sales (excluding new-build) recorded over the last 12 months in Prime Central London, which works out as fewer than 70 a week

‘Significant buying opportunity’ in PCL as prices rewind and volumes continue to tumble

With average prices pretty much where they were four years ago and transactions levels at a record low, there is a window before positive sentiment returns and the market rallies, says investment firm…

High-end bargain hunters push PCL price growth into positive territory

"Compelling" price reductions are driving deal numbers at the upper end of the PCL market, reports LCP, effectively skewing the average value...

Stamp duty revenue sinks further as transaction slump takes Government by surprise

Revenue in the four months to July fell to £3.91 billion, reflecting "lower-than-expected residential property transactions and a weaker London housing market"