Company Tag: London Central Portfolio

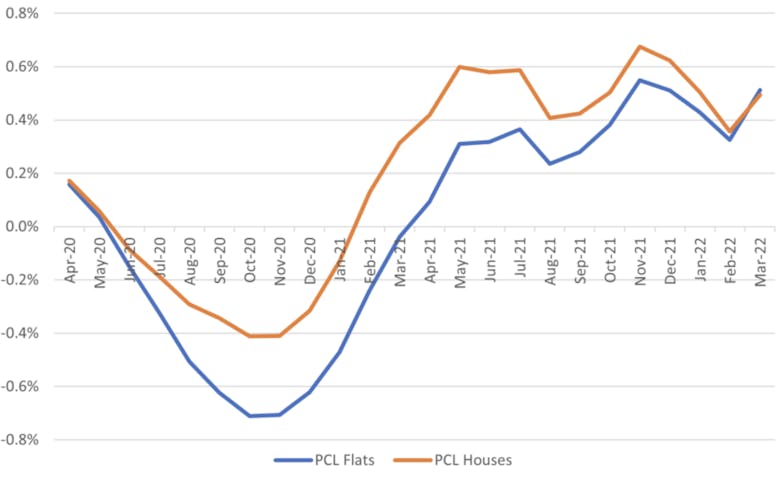

PCL house values recover to peak levels after seven years

Values have returned to the highs of 2015, before tax hikes, Brexit disruptions and Covid, reports LCP.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Savills, TwentyCi, Zoopla, Knight Frank, GetAgent & more...

‘2022 will be remembered as a boom year for residential landlords’ – LCP

Newly-agreed rental prices in prime London jumped 19% in 2022, says a specialist buy-to-let buying agency, while renewal prices surged 7.4% in Q4.

London buying agency rolls out furnishing packages for prime property investors

LCP is pitching the new service as 'a cost-effective alternative to furnishing a rental property with an interior designer.'

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Savills, Zoopla, the BoE, Knight Frank, LCP & more...

‘This is a low volume market’: Only 12 house sales recorded per week in PCL

Rolling 12-month transaction volumes are some of the lowest on record, reports LCP.

PCL apartment market poised to spring back – LCP

‘There may be buyers who look back over their shoulder with the benefit of hindsight and wish they had taken advantage of this market,’ says investment firm.

PCL tenants lock-in for longer as rents continue to soar

The average length of tenancies in Prime Central London reached a new high of 25.8 months in Q2 2022, reports LCP, while the time taken to let a vacant property is at an eight-year low.

Monday Market Review: Key figures and findings from the last seven days (w/c 25.07.22)

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LCP, Homesearch, Savills, Chestertons, Foxtons, Propertymark & more…

PCL flats return to favour as location ‘re-emerges as a key determinant’

The window of opportunity for investors is closing, says LCP.

Heatmapped: Resurgent PCL catching up with the rest of the capital

Latest analysis by LCP and Bricks & Logic shows effect of overseas demand beginning to return to London; is a narrowing of the price gap between apartments and houses around the corner?

Return to the office revives market for PCL flats

Renewed appetite for apartments may tempt some reluctant sellers to list their properties, suggests LCP