Company Tag: London Central Portfolio

Students overtake financial sector as PCL’s biggest renters

New research has claimed that students are now the biggest renters in prime central London, overtaking the financial sector in terms of numbers and shelling out an average of £28,866 a year in rent.

Another new hire for ‘buoyant’ LCP

Investment firm London Central Portfolio seems to be going big this year, hiring a third new recruit in just a few weeks and promoting another.

New prime central London property search manager for LCP

London Central Portfolio has hired a new property search manager to track down "the best on and off-market properties" in prime central London.

Sales volumes slip; prices rise – Land Registry

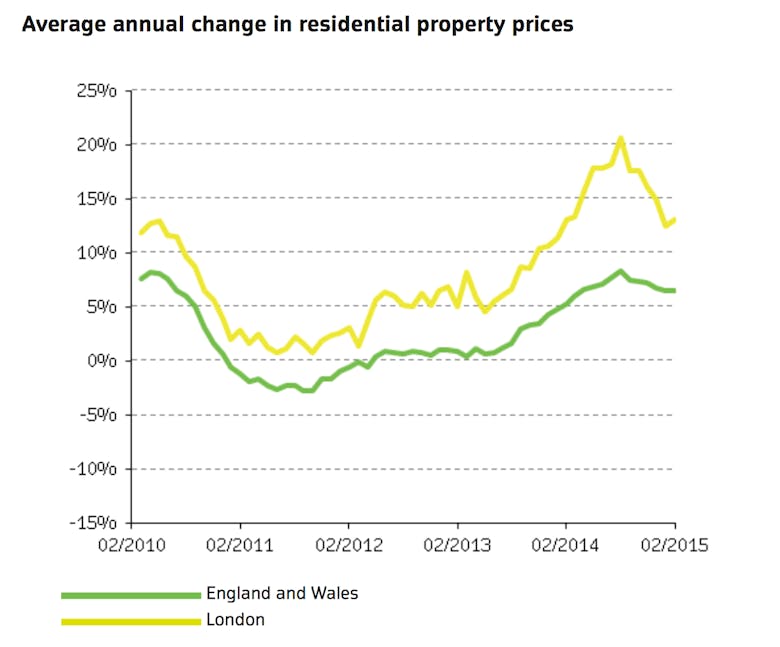

The number of £1m+ property sales has fallen by 4% compared to the same time last year - significantly less than the 11% drop in overall transactions - while average house prices have risen by 6.

Why rich-bashing is not going to fix this housing crisis

"No one is suggesting that there are not corrupt people around the world," says London Central Portfolio's Naomi Heaton, but that doesn't mean that everyone who owns a London property through an offshore company…

LCP makes ‘key’ international business development hire

Property investments consultancy London Central Portfolio has recruited a new Business Development Manager to "strengthen relationships across Europe, The Middle East and Asia Pacific Region."

Flats and maisonettes lead PCL’s price growth – LCP

Prime central London has - "contrary to generally downbeat reports in 2014" - delivered the highest level of property price growth since the economic recovery properly kicked off in 2010, says an optimistic London…

Swiss Please: Currency windfall drives ‘overnight’ surge of investors to London

Last week's surprise removal of the EURCHF floor and another cut in the deposit rate has already driven a surge of enquiries from Switzerland's wealthocracy looking to shift assets to Blighty, say property…

Rising Stamp: Surveying the new SDLT landscape

The movement from a Stamp Duty slab tax to a graduated tax is a welcome move, says residential fund management outfit LCP on the first day of the new SDLT regime.

Crib Sheet: 2015’s CGT for non-residents

HMRC has confirmed a few things about next year's imposition of Capital Gains Tax for non-residents.

‘Unexpected’ Q3 price rise for PCL and the second most expensive deal on the Registry – LCP

The number of resi transactions across England and Wales is now at nearly double its credit crunch low-point, says London Central Portfolio, after a 27.8% increase over the last 12 months.

House prices will take five years to ‘even catch up with their pre-credit crunch level’ – LCP

Following up on its cutting down of the the most recent Land Registry HPI stats, which showed a 0.