Company Tag: Lloyds Bank

‘Investor sentiment’ in UK property tumbles further, reaching the lowest level since the EU Referendum

'The property slump persists' declares Lloyds Private Banking

House prices near top state schools have risen by 15% more than surrounding areas in the last five years

RANKED: Top state schools with the highest rates of local property price inflation

First-time buyers outpace home-movers for the first time since 1995

The number of home-movers dipped by 1% in the first six months of this year, says Lloyds Bank

£1m+ home sales hit a record high in 2017, despite a slow first half

The number of seven-figure residential property sales has risen by 78% in the last decade

Two-thirds of house-builders are investing in modular construction methods

Construction innovation promises to unlock more housing supply, says Lloyds Bank

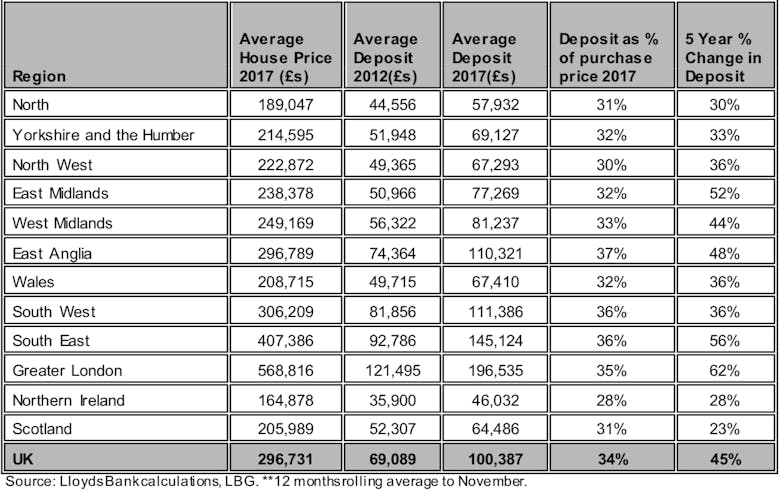

Average homemover deposit approaches £200k in London

Lloyds Bank records highest number of UK homemovers in ten years; typical homemover deposit now stands at £196,535 in the capital, nearly double the national average...

Million-pound sales rocket in Northern England

Land Registry analysis shows seven-figure deals were up by 55% in the North West and by 45% in Yorkshire and The Humber in H1

The average home in a national park is 46% more expensive than the surrounding county – but which one park offers a price discount?

The New Forest is the most expensive national park to buy a home in (averaging £581,448) and Snowdonia is the most affordable (£180,126), according to some updated research by Lloyds Bank.

Average cost of moving house in London ‘jumps to £32,000’

Lloyds Bank says that over half of the increase in average UK moving costs in 2017 has been due to stamp duty costs

The UK’s total household wealth has breached £10 trillion

Each UK household has - if everything were equal - gained £143,059 since 2006

The average property value in London has risen by 59% since the crash – Lloyds

House price inflation since 2009 has been nearly twice as fast in the capital compared to the wider country

How have sales volumes fared since 2006?

Lloyds Bank analyses a decade of Land Registry transactions across England & Wales; Greater London 'worst performer by some distance'