Company Tag: Lloyds Bank

SW city leads UK house price growth rankings

London was the only region to see property values dip in 2025, as Lloyds Bank reveals localised property market divergences.

Ranked: Britain’s most expensive seaside locations in 2025

Seaside house prices have dipped in the last year, but remain significantly higher than in 2020.

Lloyds raises house price forecasts

Britain's biggest mortgage lender expects UK house prices to rise by an average of 2% next year.

Ranked: Britain’s most expensive seaside locations in 2024

Salcombe retains its title despite price drops.

Lloyds ups house price forecasts

Mortgage lender expects the Bank of England to cut interest rates three times by the end of this year.

Lloyds tweaks house price forecasts, anticipating ‘more modest’ declines in 2024

'We expect house prices to fall between 2% and 4% this year,' says Britain’s biggest mortgage lender.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from TwentyCi, Zoopla, Savills, Oxford Economics & more…

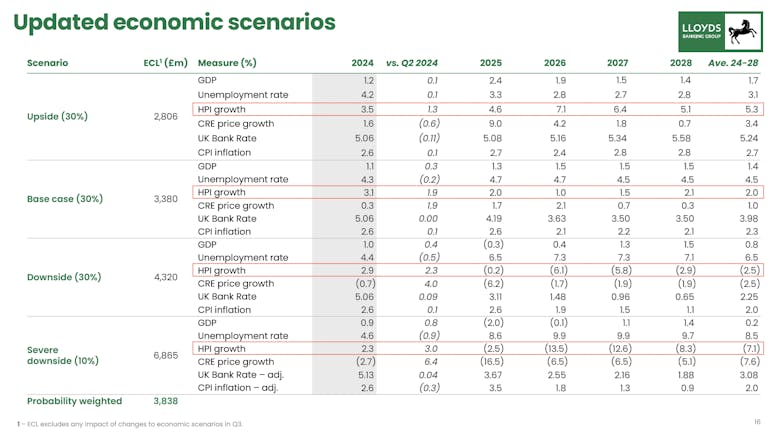

Lloyds Bank expects UK house prices to drop 8% next year

Major mortgage lender is focusing on 'slightly better-off customers', as it sets out an array of property price forecast scenarios.

Lloyds eyes massive buy-to-let expansion

Lloyds Banking Group's new buy-to-let division, Citra Living, could see its budget quadruple to £1 billion or more, according to "people familiar with the deliberations."

Lloyds Bank’s Citra aims to be Britain’s biggest private landlord by 2025

Citra Living plans to build a massive portfolio of 50,000 private rental properties over the next ten years, according to reports.

Lloyds moves into the private rental sector with Citra Living launch

Lloyds Banking Group's new stand-alone brand will "initially start small", buying up and renting out around 400 "good quality" new-build properties by the end of this year.