Company Tag: Knight Frank

Wolf Curbs: Why ‘bonus season’ has disappeared from prime central London

Fundamental changes in the financial sector have put pay to the pick-up in activity traditionally seen during the first two months of the year from bankers, notes Knight Frank...

Savills voted top grad employer

Savills has been named Graduate Employer of Choice for Property by The Times for the tenth year on the bounce.

Urban land values outperform in multi-speed market

The UK is seeing a highly regionalised housing market reflected in a multi-speed development land market, with urban brownfield sites powering ahead of greenfield and PCL.

What are political parties promising on housing in Scotland?

Scotland goes to the polling stations on the 5th May for its Parliamentary Election, and no electioneering would be complete without heated wrangles over housing and the property market.

Knight Frank reissues resi forecasts; splits PCL into East and West

Knight Frank has taken another look at its predictions (the last review was in November), adding in a few "new challenges" now faced by the UK market.

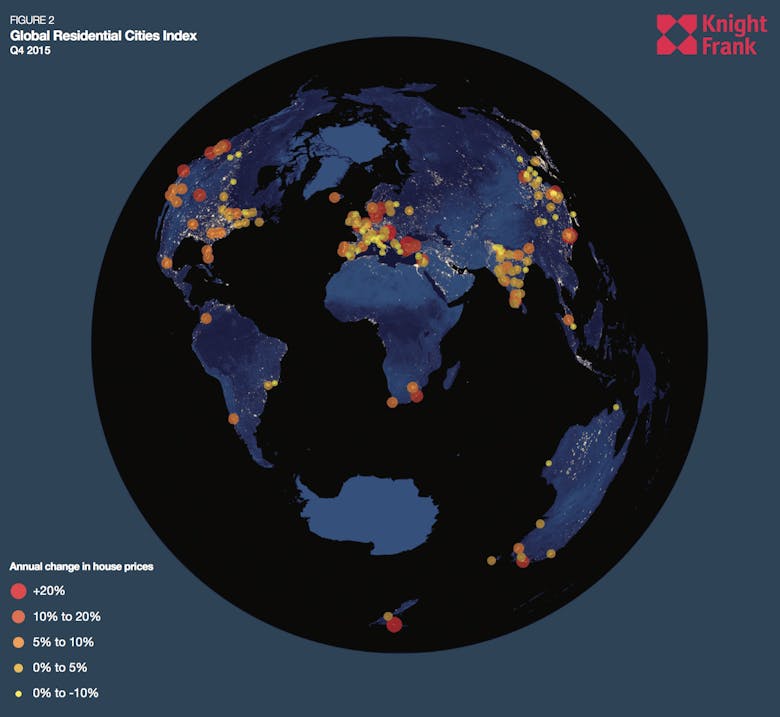

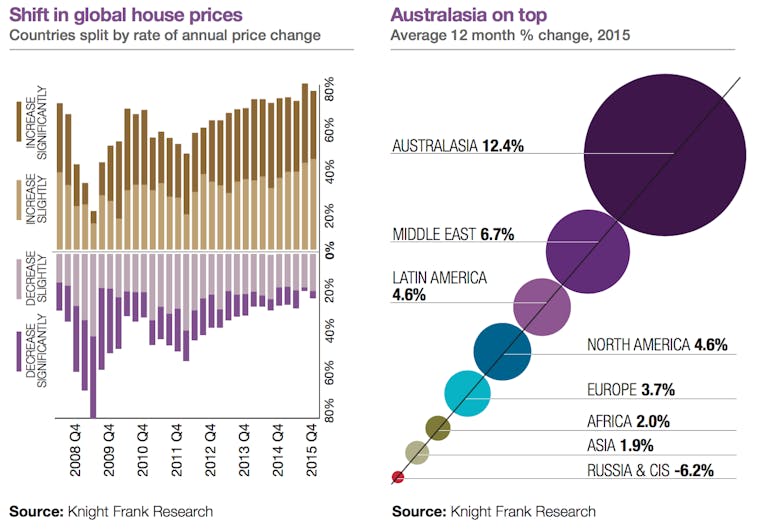

Shenzhen soars as global cities outperform national averages

Property prices in the world's urban centres are out-performing broader national figures, according to Knight Frank's latest statistical foray.

Three years of perceived house price growth as ‘the fundamentals remain steady’

UK households think that the value of their property has risen every month for the last three years, according to the latest sentiment survey by Knight Frank and Markit.

#Budget2016: The prime property industry reacts

"Meh" pretty much sums up a lot of reactions to Chancellor George's eighth Budget speech.

A ‘dangerous cocktail’ mutes the outlook for global house prices in 2016

The global economy is supping on a "dangerous cocktail", says Knight Frank, as low oil prices, a strong dollar and a struggling China combine to quell expectations of property price increases in the coming…

Succession and inheritance top UHNWI worries

Succession and inheritance issues, wealth taxes and the global economy are the main issues keeping the world's wealthy awake at night, according to a new poll of top UHNWI advisors.

Luxury investments shine as passion assets rule

The ultra-wealthy can now please both their heads and hearts: investments of passion are on the up, as the value of the Knight Frank Luxury Investment Index (KFLII) rose by 7% during 2015, according…

Global UHNWI population slips 3% as London retains prime position

London is still the "most important" world city for the ultra-rich, says Knight Frank in its tenth annual Wealth Report.