Company Tag: Knight Frank

Prime Scottish prices dip but Edinburgh rallies despite EU uncertainty

Prime property prices in Scotland dropped by 0.4% between April and June, says Knight Frank, leaving them 0.6% lower than at this time last year.

How have the world’s top resi markets been performing this year?

The latest instalment of Knight Frank’s Global Residential Cities Index, which tracks the performance of mainstream house prices across 150 cities, sees Shenzhen continuing to lead the world rankings…

Deals are back on the table as prime central London transactions jump 29% (from a low base)

Deal numbers in prime central London rallied by 29% in the week following the Brexit vote (compared to the same week in May), says Knight Frank, but, as already reported by Savills, prices dipped in June…

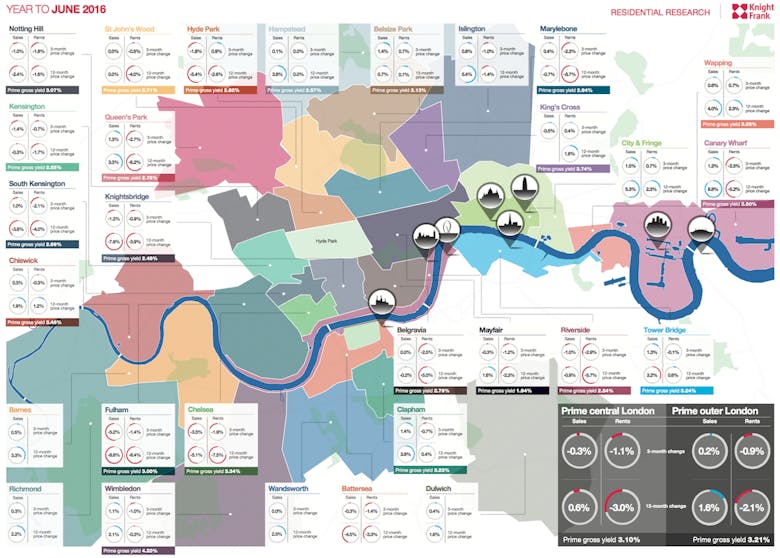

Mapped: Prime London property markets in the year to June

It's a patchy picture across prime London's sales and rental markets, with headline numbers disguising some significant differences between local areas.

New recruits for Knight Frank Oxford

Knight Frank has boosted its capability in Oxford with two new recruits as it continues to increase market share in the region.

Dane Spelina

High-value country house prices tumble in Q2

The price of large prime country houses (above £2m) dropped by an average of 1.

Prime global rents fall for third quarter in a row

Top-end rents around the world have fallen for the third consecutive quarter, says Knight Frank, as London slips to 11th in the firm's prime rental rankings.

Overall, prime rents dropped by 0.

Buyer bags £26.5m unmod Eaton Square mansion

One of the biggest deals of the year so far

Former CLA Surveyor joins Knight Frank

Knight Frank has recruited Tim Broomhead to its Rural Consultancy division.

It’s Not EU: Property industry reactions to Britain’s vote to leave the European Union

This, if the Remain campaign bunf was actually accurate, is the end of days.

Knight Frank boosts resi development division

Knight Frank has strengthened its resi development department with another hire.

New head for Knight Frank Harrogate

Knight Frank has recruited Daniel Rigg to lead its Harrogate operation.