Sales

Prime Central London: Global city of the future or global city of the past?

Key takeaways from the recent Wealth Breakfast at Burlington House, where a panel of experts delved deep into the mechanics of the capital's prime property market.

Mortgage approvals rise as interest rates stabilise

Bank of England data tell of another increase in mortgage approvals, prompting Savills to suggest 'some confidence is beginning to return' to the property market.

Which property types have bucked the trend in prime London this year?

While studios and small flats have struggled in the cooling conditions, foreign buyers have been driving the market for certain family-suitable homes, reports Benham & Reeves.

Prime London Property Market Snapshot: Week 47, 2023

Deal numbers continue to slide in prime London, but the last week has seen a decent increase in new sales instructions.

House prices to rise in London next year, but dip across the UK – Chestertons

Recovery will be 'slow and steady rather than spectacular', says high-profile agency.

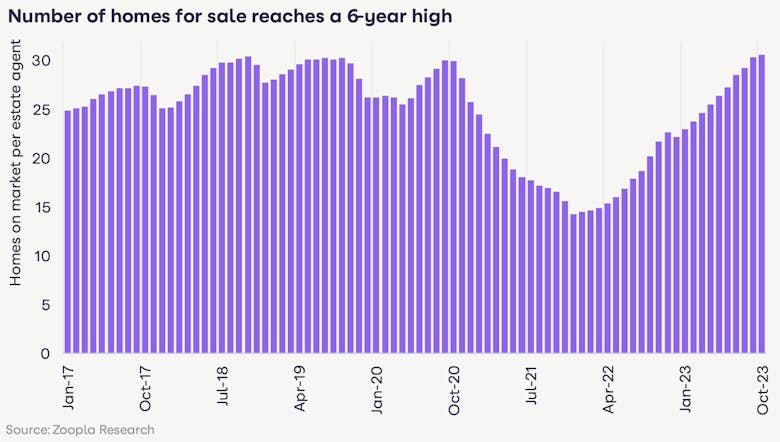

‘These are the best conditions for home buyers for some years’ – Zoopla

Property prices are still falling across most of the UK as supply improves - with buyers in London and the South East securing the biggest asking price discounts.

Self-employed agents ‘rapidly’ gaining market share

Footloose operators are now strong competitors for traditional established brands, says data firm.

London’s super-rich turn to rental homes as ‘rival wealth hubs’ entice billionaire buyers

Fresh analysis by luxury estate agency Beauchamp Estates looks into the wealth and lifestyles of the global super-rich.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Beauchamp Estates, Savills, Knight Frank, Foxtons, the OBR, Jackson-Stops, OnTheMarket &…

London property market is at a ‘turning point’ says Foxtons

'Now is a good time to buy' a property in the capital, says estate agency.

House prices likely to fall 4.7% next year – OBR

House prices are likely to bottom out at the end of 2024, before "recovering slowly" to reach their late-2022 peak level in the second half of 2027.

The off-market arena isn’t about working in the shadows…

...it's about the art of the deal, writes Anderson Rose's Jon Byers...