Sales

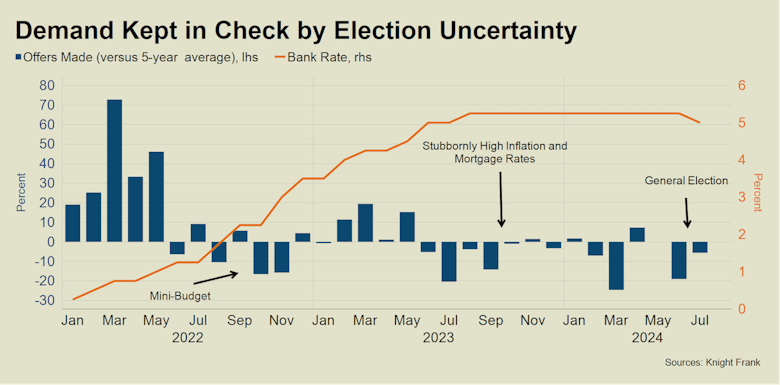

Offer numbers drop off in Prime London

Buyers in the prime postcodes were more focussed on their summer holidays than moving house in June and July, reports Knight Frank.

‘Shaken not stirred’: Ollie Marshall on why London remains one of the best haven bets out there

PCL house prices have not been tearing up the record books of late, but they are now at far less risk of a sharp recalibration and deleveraging than other markets, explains top buying agent.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from the RICS, TwentyCi, Knight Frank, Prime Purchase, Savills, Hamptons, Halifax & more...

UK property market on a gradual, albeit uneven, recovery path – Acadata

Latest index shows prices are now just 1.3% lower than a year ago.

Law firm warns some sellers could be in for a ‘nasty shock’ later this year

'I now firmly believe capital gains tax rates will be increased', says Matt Spencer of Kingsley Napley - so what are the options for those planning to sell in the near future?

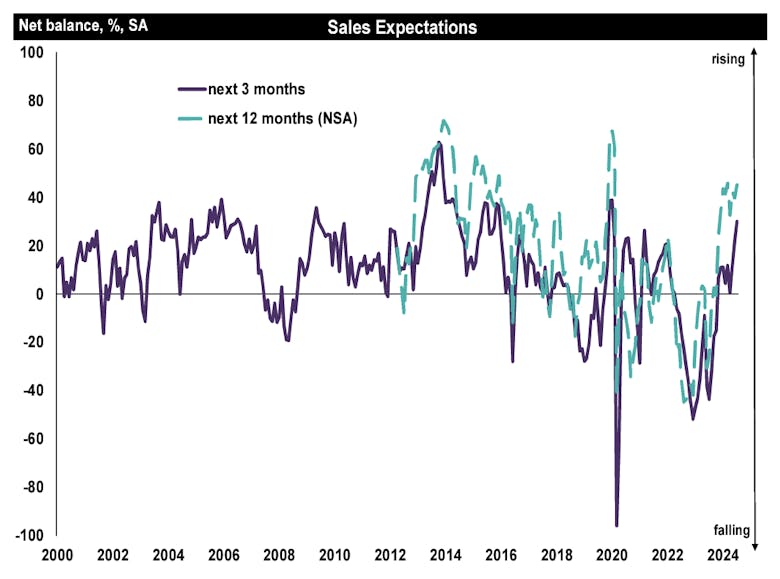

Property market got ‘a bit sunnier in July’ – RICS

Surveyors are feeling more positive about the sales market than at any time since January 2020.

Valuation Viewpoint: Exodus means property taxation

Wealthy people are leaving the UK & the government will need to make some tough choices as a result, warns Parthenia's James Wyatt.

Grand Registry: Surveying last month’s biggest registered deals

Latest batch of super-prime registrations led by country residences in Hampshire & Surrey and townhouses in Notting Hill & St John's Wood.

Prime London Property Market Snapshot: Week 31, 2024

The latest LonRes data suggests buying activity bounced back last week.

‘Few signs of a property market bounce’ following election

But Hamptons has unearthed an interesting trend behind the headline numbers...

Tom Bill: Rate cut will boost demand but Budget uncertainty lingers

Mortgage costs are expected to fall further after the Bank of England’s decision to cut rates last week, but the prospect of tax rises may dampen demand in prime markets, says Knight Frank's UK resi…

On navigating evolving HNW real estate needs: Top private bank explores a ‘nuanced landscape’

Barclays Private Bank's Stephen Moroukian explains where wealthy clients are focusing their attentions as the prime property climate improves.