Sales

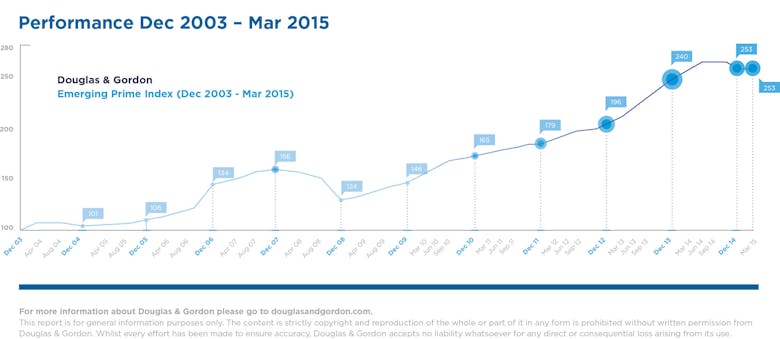

Clapham shines as emerging prime ‘proves robust’ ahead of election day

Today's Sloane Ranger Handbook would be more about the Northcote Road than the Kings Road, says Douglas & Gordon, as Clapham turns in a stellar Q1 and emerging prime areas outperform traditionally prime…

The Property Boat Race: Hammersmith and Chiswick battle it out in price growth stakes

The rowers and coxes are limbering up for tomorrow's BNY Mellon Boat Race and it's shaping up to be a scorcher; the only thing missing now is some topical riverside house price analysis...

Boris Bike rollout will open up opportunities for buyers and sellers alike – Marsh & Parsons

Turns out it's not all about tube stops, schools and Waitroses any more; potential buyers are increasingly keen to find out about proximity to a Boris Bike docking station, according to one London agent.

New-build Boltons mansion goes for over £50m

A monster deal from last year has just come to light, topping the scales at £51.7m.

Prime country house price growth overtakes central London, but £5m+ values tumble

Prime country house prices increased by 0.9% between January and March, says Knight Frank, taking the rate of annual price growth down from December's +3.4% to a more modest +2.

Harrods Estates continues PCL expansion with new Kensington office

Harrods Estates will be throwing open the doors to its new Kensington base at the end of the month.

All Change In Nappy Valley: Where is the next Northcote Road?

The prime south west London market couldn't look more different than it did a year ago, says buying agent Sara Ransom...

Brighton’s Hanningtons Estate ‘a snip’ at £50m

A significant chunk of Brighton's old town has been put up for sale.

The former Hanningtons Department store in Brighton

Flurry of sales for political pied-a-terres

Three separate pied-a-terres in one of Westminster’s most popular residential blocks for MPs have gone under offer within two weeks of each other, as the countdown to the General Election begins.

97% more Londoners look to buy in Edinburgh

Property prices in Edinburgh rose by 1.2% between January and March 2015, to take annual growth to +4.1%, as buyers look to complete deals ahead of tomorrow's (1st April) tax changes, says Knight Frank.

Mayfair set to breach £6,000 psf this year as Indian investors drive the market up

NW8-based boutique agency Rescorp Residential has netted a £5,000 psf sale on South Audley Street W1, and predicts that Mayfair prices will breach £6,000 psf by the end of the year as Indian investors move…

Opportunity Knocking: ‘Act now’ if you want a great deal in prime central London

Those able to move quickly may get a property that will look very good value in just a few months, says buying agent Nathalie Hirst...