Sales

Alchemi wins bid on Nine Elms tower scheme

Grand South site at 12-20 Wyvil Road has planning for a 36-storey development

Mayfair & Marylebone car parks ‘concealing’ £1.3bn of prime resi development land

It's been reckoned that 18 large multi-storey car parks across Mayfair and Marylebone sit on over £1.3 billion worth of prime residential development land.

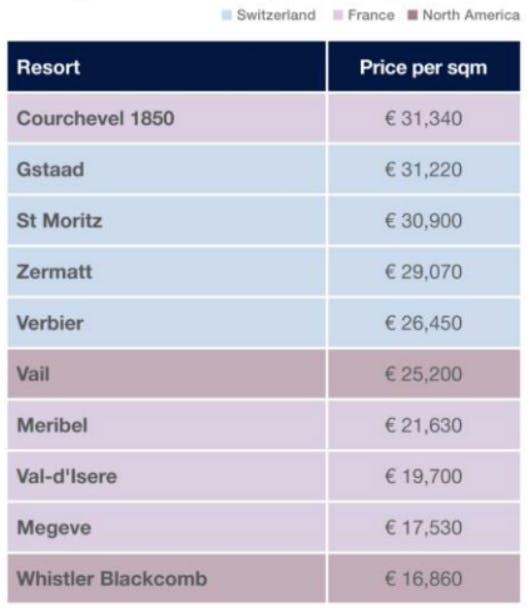

Courchevel 1850 tops ultra-prime ski resort league

France's Courchevel 1850 has maintained its status as the world's toppiest ski resort for another year, straddling Savills' Ultra-Prime Ski Resort Index with typical prices of €31,340 per square…

On Locations: Dulwich, the UK’s top property performer

House prices in Dulwich have increased by 897% since Land Registry records began in 1995; that's the strongest growth recorded anywhere in the UK and the equivalent of 12% a year for two decades.

Another Home Counties acquisition for Strutt & Parker

Strutt & Parker has snapped up a three-office agency with a strong presence across Surrey and Berkshire.

The complicated reality of choosing the right development

Developers are scrambling to meet demand for prime residential property in London but not all schemes are created equal, notes Camilla Dell in her latest market round-up...

Maskells boosts sales arm with two senior hires

One of the oldest independent agencies operating in prime central London, Maskells, has significantly bolstered its sales operation with two big appointments.

Howard Elston

Grosvenor offers two Mayfair blocks for £120m

Grosvenor has put the long leases of two super-prime residential developments in the heart of Mayfair up for sale for £120m.

Bricks & Mortals: What does ‘safe’ mean in the London property market today?

When it comes to investing in the capital's property market, the term 'safe' has taken on a very different meaning in recent years;

First Look: Wilben’s new £32.5m townhouse on Chester Square

The boutique development firm set up by twin brothers William and Benjamin Samuels has just put the finishing touches to its most ambitious project to date - an absolute belter in one of the best bits of…

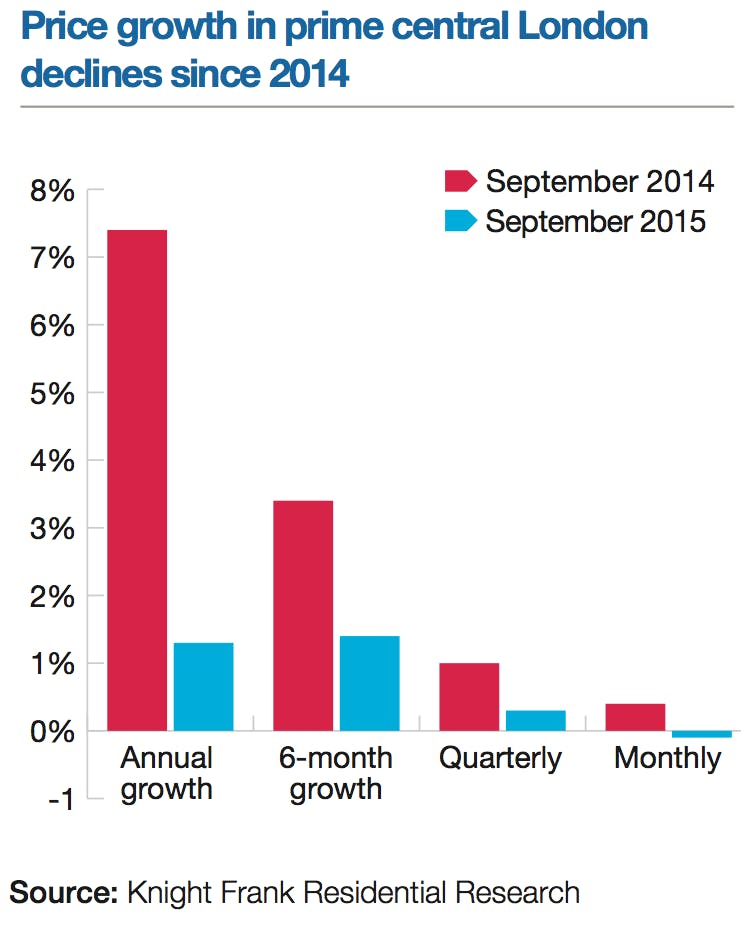

‘Flight to quality’ in divided PCL as buyers stay cautious

The prime central London market changed up a gear in September, says Knight Frank, but performance has varied dramatically across town and we're still some way off a full-blown recovery.

Surrey agency goes interactive with ‘intelligent’ window

A Surrey estate agency has installed a neat gizmo in its high street branch to harvest applicants 24/7.