Sales

New platform to build ‘largest crowdfunded property portfolio in London’

Yet another new addition to the crowded property crowdfunding sector is gearing up to take on the world.

L&Q swoops on £150m Wandsworth scheme

L&Q has snapped up a significant regen opportunity in Wandsworth.

Alchemi unveils grand Leinster Square renovation project

Developer Alchemi Group has pulled the covers back on its latest PCL endeavour.

The row of six Grade II listed Victorian townhouses on Bayswater's Leinster Square (Nos.

Grosvenor prepares for ‘inevitable’ market correction

Grosvenor has reported a 22% fall in pre-tax profits in its latest set of results.

Profit before tax of £527m was recorded by the Duke of Westminster's property group, down from 2014's £681.

Planning nod for major new Paddington scheme

Westminster Council has green-lighted Berkeley Group's plans to transform West End Green.

The developer bagged the long-term vacant 2.

Rare prime Highgate development site up for sale

Nearly an acre of prime Highgate has just hit the market with planning for a seven-house scheme.

Is this the magic equation for ‘correctly’ valuing a property?

No, because everyone knows that doesn't exist. A buying agency has had a pretty good stab at it though.

Why 2016 could be a very British year for super-prime property

Although London is still the number one city for UHNWIs, it is British buyers who are now at the forefront of the super-prime property market, says Joe Burns...

Ten-bed Phillimore mansion up for £36m

One of the biggest open-market instructions of the year has launched on Kensington's ultra-prime Upper Phillimore Gardens.

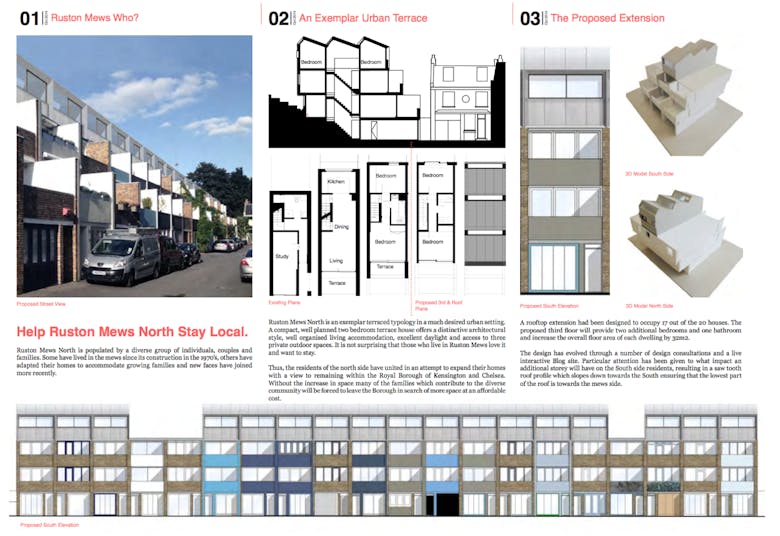

Planning nod for mass roof extension scheme in Ladbroke Grove

Eighteen residents of Ruston Mews in W11 have been given the go-ahead to carry out a joint roof extension after winning an appeal.

Mount Anvil and Farrells complete ‘landmark’ Tech City project

Farrells and Mount Anvil have put the finishing touches to their major new Silicon Roundabout scheme, The Eagle.

How the prime markets beyond London have been performing

The price gap between London and the prime regions has begun to narrow, albeit very slowly, says Savills' Lucian Cook...