Sales

PCL vendors held back in Q4, but activity is now likely to pick up

It was a subdued end to the year for Prime Central London's property market, reports Knight Frank in its Q4 sit rep, with 17% fewer £1m+ properties listed for sale in November 2019 compared to the same…

Housing market activity ‘unlikely to shift up materially in 2020’ – RICS

Surveyors predict 2% growth for UK house prices this year, but no improvement in transaction volumes

‘Signs of recovery’ for prime London’s property market as prices turn up

Q4 2019 saw the first quarterly increase for average property prices in Prime Central London in four years, according to Savills

Country house market remains flat

Prime regional property prices fell by 0.8% in 2019, says Knight Frank, and have been flat or falling for the last three years.

Ranked: Britain’s best value commuter towns

Zoopla reveals Britain’s most affordable towns for rail commuters to London, Birmingham, Bristol, Manchester and Edinburgh

Ranked: Britain’s most popular house-hunting locations

Bristol was 2019's most-searched location outside London for both buyers and tenants, according to new Rightmove data. In London, Wimbledon was the most popular location for would-be buyers;

PCL agencies were sharing just 60 sales per week in 2019

London's most expensive postcodes put in a 'very weak' performance this year, reports investment firm LCP, with sliding prices and precious few deals to go round...

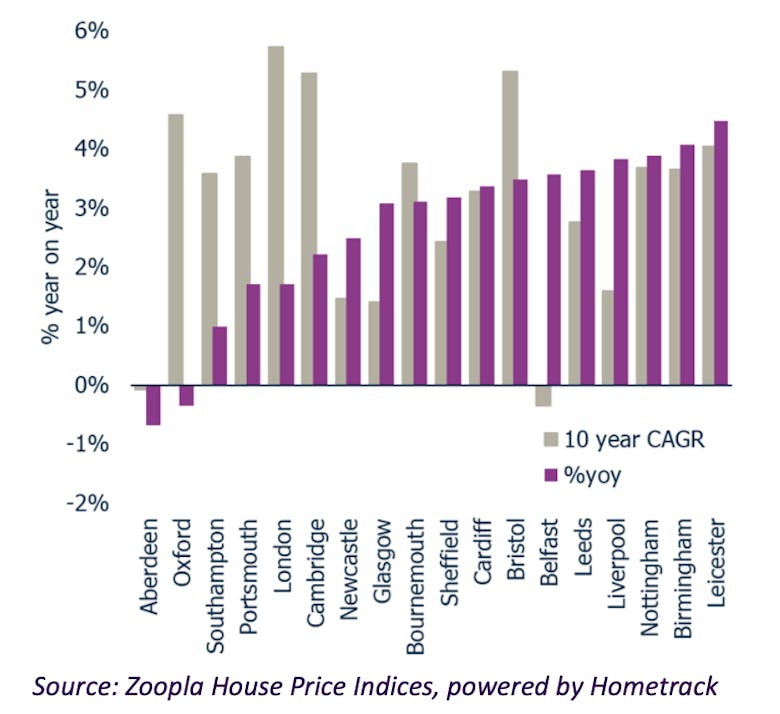

Zoopla predicts 3% growth for property prices in UK cities in 2020

The average property price in a UK city has increased by 54% over the last decade; London has seen 74% growth.

All is calm, all is bright: Post-election thoughts

There is no denying the instant relief felt by stakeholders in the prime London property market following the general election result, write Sophie & Richard Rogerson, but there are real concerns this…

Resi investors shun Canary Wharf

Canary Wharf is transitioning into a place to live as well as work, says Savills; a third of buyers in the area are international, and over a third of households earn more than £100k a year.

Knight Frank predicts ‘rising momentum across all property markets’, with PCL set to out-perform

Prime Central London property prices are likely to rise by 18% over the next five years, forecasts Knight Frank, out-performing mainstream markets.

House price growth drops to the lowest level since September 2012

The latest official UK House Price Index tells of a slow property market in the run-up to the General Election.