Sales

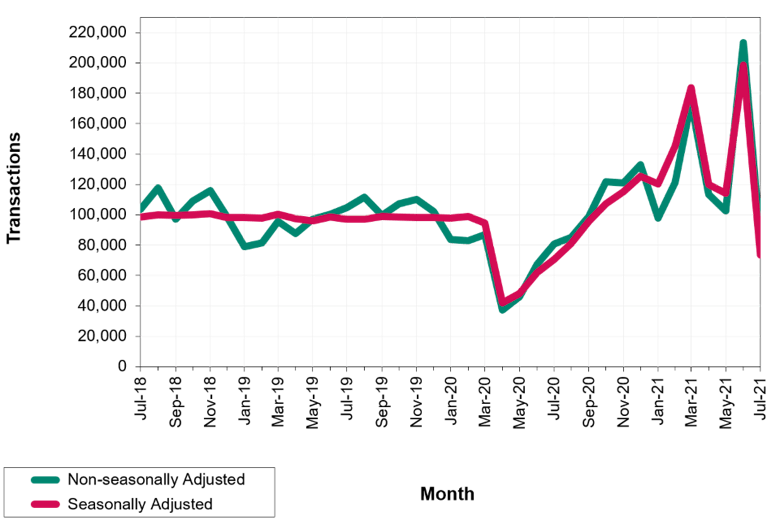

Transaction numbers plunge following Stamp Duty deadline

Official estimates tell of a 63% drop in residential property sales from June to July - but transactions are still running above last year's level.

Mapped: Established & emerging PCL neighbourhoods

Cluttons takes a look at the evolution of Prime Central London.

PCL developer reports massive spike in UAE enquiries as travel restrictions ease

‘The coming months will be dominated by eager buyers from the Middle East looking to invest in the capital,’ predicts Almacantar.

Number of £1m-plus homes jumps by 100,000

Another 98,931 properties have joined the seven-figure club in the last 12 months, according to TwentyCi

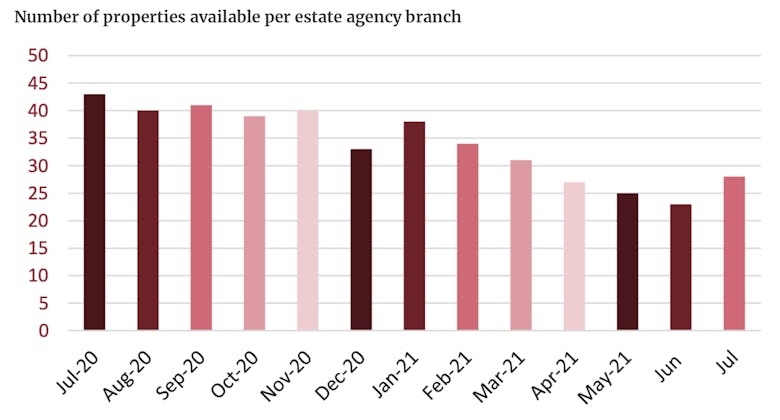

‘Signs of stabilisation’ as property supply picks up

"This month’s slight rebalance of the market is welcome news and a much-needed step in the right direction," says Propertmark's CEO, "with supply of property beginning to increase and the number of homes…

Estate agent: ‘The supercars are back’

First signs reported of wealthy Gulf buyers returning to PCL.

Stamp duty receipts above average despite holiday

Latest data shows strength of the prime market & continued interest from overseas buyers - despite the new surcharge…

Average property prices leapt 4.5% in the month before the Stamp Duty holiday deadline – UK HPI

The average UK house price increased by 13.2% in the year to June 2021, up from 9.8% in May, according to the latest official UK HPI.

Savvy investors are swimming against the tide in global cities

Those who took advantage of staggering price depreciation in some of the world’s top centres are starting to reap the rewards, writes Mickey Alam Khan…

More high-end stock going under the hammer – Knight Frank

Auctions are an increasingly popular choice for clients fed up with delays, says Knight Frank, reporting recent sales including a £1.

Townhouse sets new price record on Connaught Square

Savills Mayfair has reported a strong run of sales in Connaught Village, describing the Bayswater neighbourhood as a ‘hidden gem’.

Strutt & Parker doubles UK house price forecast for 2021

“The demand for new ways of living will drive the market for many years to come," says national estate agency Strutt & Parker as it suggests that UK house prices will rise by up to 35% over the next…