Sales

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest market movements in less than five minutes, featuring data and analysis from LonRes, Knight Frank, Savills, Rightmove, Zoopla & more...

Prime London Market Snapshot: Tight supply & returning demand push prices & rents up in PCL

"The property markets in central and outer London are increasingly on different trajectories," says Knight Frank, as the latest market indices shine a light on sales and lettings trends.

Lucy Barber: How to buy a property at auction

Auctions have seen a surge in popularity over the last few years, with an increasing number of prime properties going under the hammer.

Mortgage lending stays well-above pre-pandemic norms

The latest Bank of England data show a slight drop in mortgage approvals.

UK house price growth hits a 15-year high, but supply is starting to improve – Zoopla

Surging house price inflation has pushed 4.3 million homes into a higher stamp duty bracket since the start of the pandemic, estimates Zoopla.

Rising interest rates & cost of living ‘yet to impact’ prime property buyer budgets

“With the market as competitive as it is, motivated buyers can ill afford to reduce budgets, despite rises to mortgage rates and household bills," says Savills.

Bath named Britain’s city property hotspot, as asking prices jump 15% in a year

Rightmove charts which UK cities have seen the biggest leaps in average asking prices in the last 12 months.

UK house prices likely to fall in 2023 & 2024, predicts Capital Economics

Influential forecasting house expects average property values to drop by 5% overall through 2023 and 2024.

The average estate agent sold 19% more homes in 2021 than in 2020

Estate agencies sold an average of 46 properties in 2021 - seven more than in the previous year.

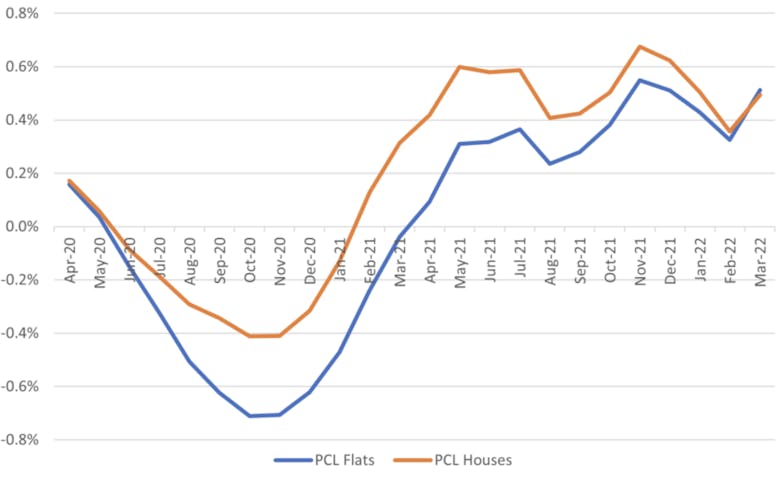

Return to the office revives market for PCL flats

Renewed appetite for apartments may tempt some reluctant sellers to list their properties, suggests LCP

Talking Heads: What’s happening in the prime property market right now, according to top buying agents

Where is all the stock; what will happen to prices; and which areas are buyers flocking to right now?

International execs returning to PCL, reports agency

Corporate relocation searches were up by 150% in Q1, according to Winkworth, in a 'positive sign' for the sales market