Sales

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from the RICS, Knight Frank, Hamptons International, LonRes & more…

The Sunday Times: Why one in ten properties are sold in secret

"Frenzied demand from buyers and a shortage of properties for sale have led to a boom in off-market sales, where homes are sold without being listed on an estate agent’s website or a property portal,"…

Estate agents report drop in buyer demand, but house prices continue to climb – RICS

Property prices may prove "resilient" in the face of rising interest rates and costs of living, but transaction numbers are "likely to slow as the year wears on," warn surveyors.

Asking price to sold price gap shrinks

Average asking prices are rising at a slower pace than achieved sold prices, according to some analysis by London estate agency Benham and Reeves.

‘The dynamism of cities is reasserting itself’: Global city house prices out-perform national averages

House price growth in global cities is outpacing national averages, according to Knight Frank's latest indices - but signs point to a general property market slowdown.

Buyers digging deeper for super-sized homes

LonRes reports on Prime London's palatial price premiums

High-end sales still surging in Prime London

LonRes records spike in under-offer numbers as prices breach pre-pandemic levels

‘Concerns over the property market are overstated’ – Fine & Country boss

"The wealthier you are, the more confident you are," says a bullish Simon Leadbetter, Global CEO of Fine & Country.

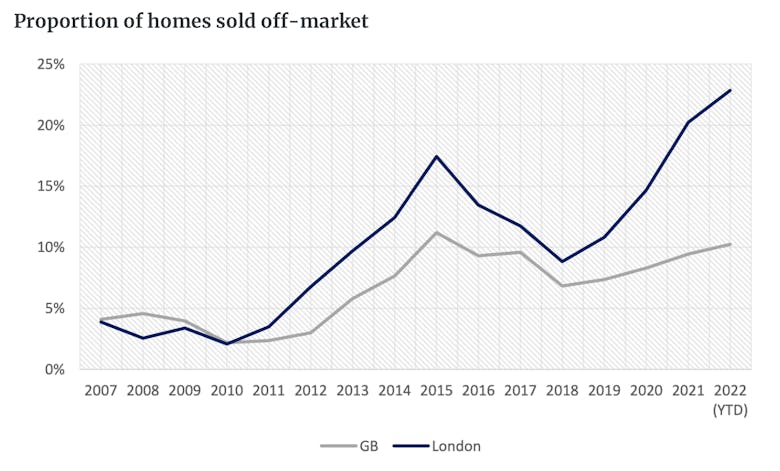

Off-market property sales soar as mainstream sellers embrace discreet marketing

One in ten homes sold across the UK so far in 2022 were only marketed quietly, rather than being openly broadcast on the portals. That figure rises to nearly a quarter in London and prime country markets.

Deal numbers hold up despite low stock

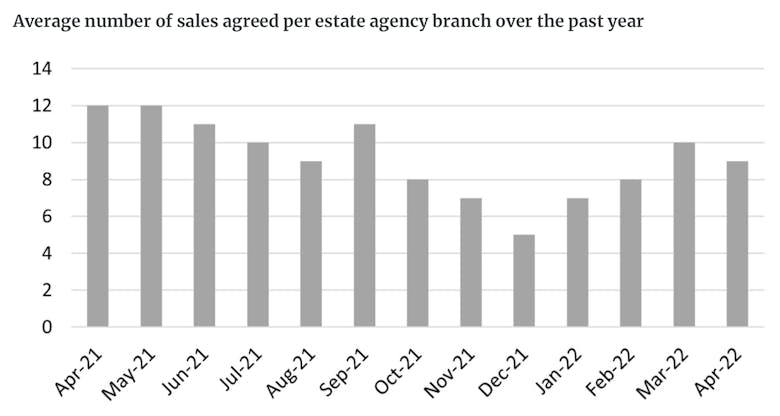

Estate agents agreed an average of nine sales per branch in April, says Propertymark - roughly in line with the long-term average, despite a continued shortage of homes available to buy.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Propertymark, Knight Frank, Hamptons International, Savills & more…

Developers under pressure to deliver as new-build reservations soar

Regional reservations were up 41% on pre-pandemic levels in the first few months of this year, but housebuilders are having a hard time keeping up with the demand