Sales

PCL prices are rising at their fastest rate since 2014, but remain 17.6% below their peak

Savills is forecasting a slow and steady recovery - rather than a sharp uptick - for London’s golden postcodes, unless high net worth foreign investors return in their pre-pandemic numbers…

The property market is ‘no longer brimming with confidence’ – Garrington

The property market "has continued to defy expectations" through the latest (ongoing) batch of political and economic uncertainty, reports national buying agency Garrington, with most indices pointing…

Monday Market Review: Key figures and findings from the last seven days (w/c 18.07.22)

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from Foxtons, Rightmove, HMRC, TwentyCi, Zoopla & more…

UK property market ‘defying all odds’ as more households gear up to move

Perhaps this is the new normal, suggests TwentyCi…

Property market moves ‘back to normal’ as Summer heat cools – Propertymark

Another market index tells of slowing buyer demand and less pressure on house prices.

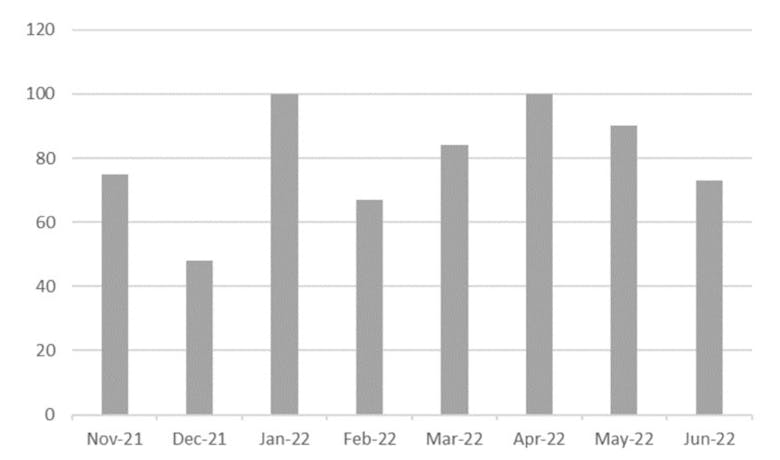

Transaction numbers tumble from last year’s high

HMRC recorded 55% fewer residential property sales in June this year compared to last; it's the slowest June in nine years.

Vendors are now achieving 99.4% of asking price, on average

More property sellers are getting closer to their asking price now than last year, with 41% of postcodes seeing the average deal being done at or above asking.

Talking Heads: How fast will the property market slow?

"There is no doubt that there is a cool breeze blowing in the London market,” says Roarie Scarisbrick of buying agency Property Vision - but the consensus amongst 21 prime property pundits canvassed…

Annual house price growth climbs to +12.8% – UK HPI

The latest official house price index tells of a 1.2% monthly increase for the average UK home in May, up from a 0.4% rise in the same period last year.

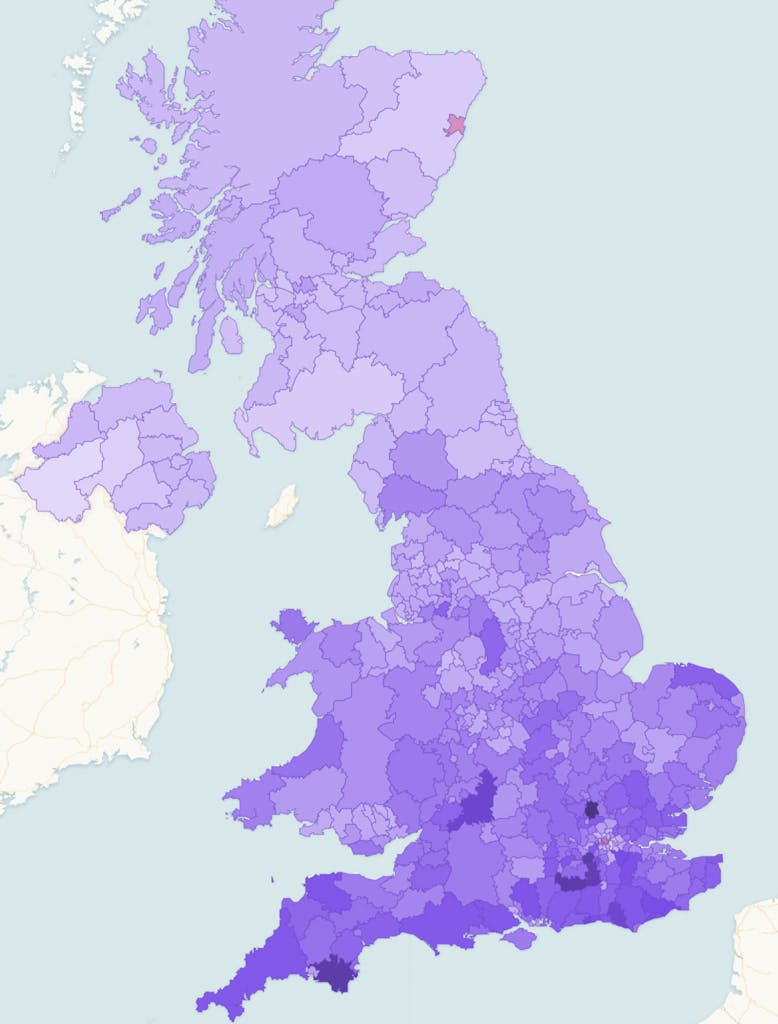

Mapped: Areas with the highest (& lowest) daily property price growth since the start of the pandemic

Zoopla estimates that the average UK home has seen its value climb by £48 every day since March 2020 - but some areas have seen significantly higher growth of up £106, while the value of many London…

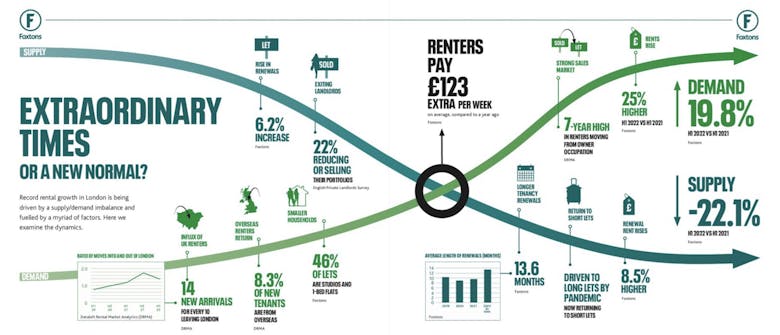

Five graphs that show what’s really happening in the London lettings market in 2022

Foxtons gets to grips with the supply/demand imbalance that’s driving rents skywards.

Prime country house price growth cools sharply as supply improves

Britain's country house market "is normalising" after a two-year pandemic-driven boom, suggests Knight Frank as price growth peaks.