Sales

Ollie Marshall: How the past few years have created a ‘perfect storm’ for dollar-based purchasers

Neighbourhoods with the greatest international appeal are likely to outgun mainstream UK markets for the foreseeable future.

One in three high-value homebuyers now buys beyond London

"The days of London being the default location of choice for high-value house purchases are increasingly behind us," says Search Acumen boss Andy Sommerville, "as big spending homebuyers look to invest…

Rich pickings for US buyers in Knightsbridge, Chelsea & Notting Hill as sterling takes a pounding

It may be world famous as a luxury retail destination, but Knightsbridge has emerged as the discount capital of PCL for dollar-based property buyers.

Major mortgage lenders pull products amidst market turmoil

Virgin Money, Halifax and the Skipton Building Society are amongst those to have pulled mortgage products.

Wealthy dollar buyers pounce on London property as sterling slumps

Top-end London property brokers are enjoying a bonanza of urgent interest from wealthy international buyers with US dollars to spend, looking to take advantage of a significant currency discount.

‘Surprisingly resilient’ property market as supply returns to pre-pandemic levels – Rightmove

Asking prices continue to climb despite mounting economic pressures, reports Britain's biggest property portal.

Kwarteng’s tax cuts ‘will boost London housing market deals by up to 30%’ predicts top estate agency

Dexters' boss Andy Shepherd is very bullish about the capital's property market prospects.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from LonRes, TwentyCi, Savills, Knight Frank, the ONS & more…

High-end listings up by nearly a third in London as vendors ‘test the market’

'How these instructions translate into sales will provide a good barometer for the wider health of the market in the months ahead', says LonRes.

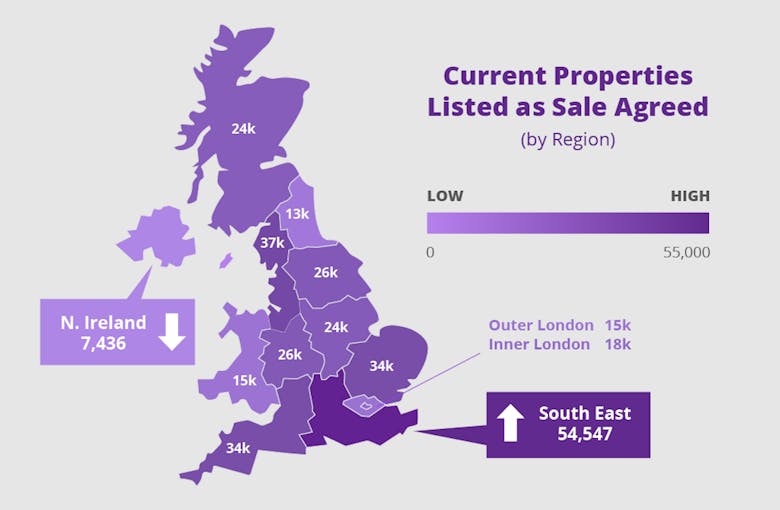

Balance returns to the housing market as new sales instructions climb

"We’re still a long way off a housing market crash, but things are showing signs of cooling somewhat," reports TwentyCi.

Buyer & seller sentiment ‘remarkably resilient’ as stock levels hit 15-month high

Property portal OnTheMarket is expecting the market to become less competitive as we head deeper into autumn, although there's no sign of a significant drop-off in buyer and seller sentiment just yet.

Country house market ‘takes a breath’, but buyer appetite remains strong

Knight Frank conducted 16% fewer country house viewings last month than in a typical August, but accepted 33% more offers.