Sales

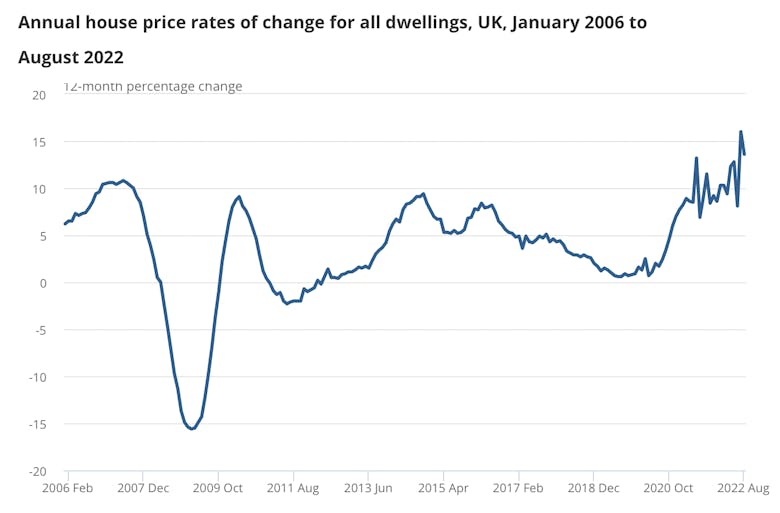

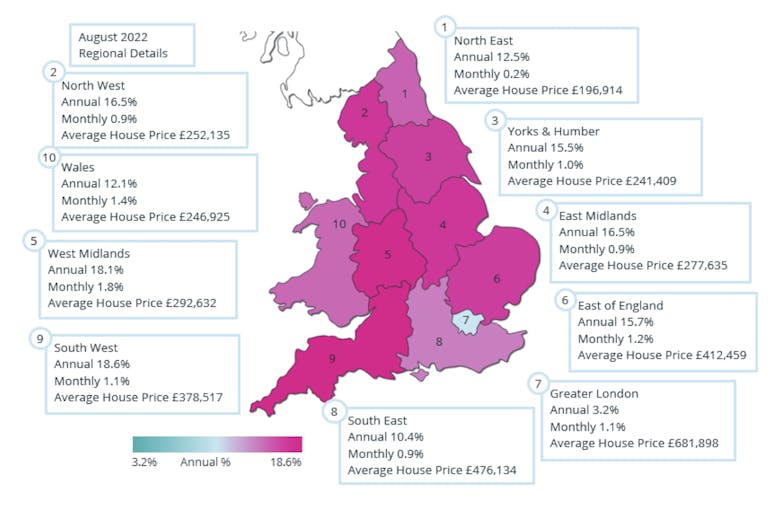

Annual house price growth slowed to +13.6% in August – UK HPI

The latest official House Price Index shows "a slight cooling in year-on-year growth, but it’s far from being a blizzard," comments Jackson-Stops boss Nick Leeming, while Knight Frank points out that…

Charlie Ellingworth: Chickens coming home to roost

This is a time of maximum gloom, writes Property Vision's Charlie Ellingworth, but property markets are nuanced - and there is no one size fits all...

Prime London flat prices jump 11.8% as the capital shows ‘a slow but steady return to health’

New analysis of LonRes data confirms that the pandemic-drive 'race for space' is over in the London, with demand for apartments now significantly outpacing that for houses.

Home-buyer & seller sentiment ‘remains robust’, says portal

'There’s evidence that buyers feel the market is moving in their favour,' says OnTheMarket boss Jason Tebb, as the portal reveals results of its September Sentiment Survey - conducted before the now-unravelled…

Lucian Cook on the role of debt in the prime resi market

Savills research chief looks at the implications of increases in the cost of living and mortgage finance for the prime housing market.

Revealed: The UK areas with the highest percentage of cash buyers

The proportion of cash buyers ranges from less than 20% in Barking & Dagenham to nearly 60% in parts of Norfolk, new research shows.

Asking prices continue to climb as some buyers pause while others rush deals through

'The vast majority of buyers who had already agreed their purchase are still going ahead,' says Rightmove, but some buyers 'have had their plans dashed by the sudden nature of the mortgage rate rises.

Monday Market Review: Key figures & findings from the last seven days

Catch up on all the latest movements and commentary in less than five minutes, featuring data and analysis from UBS, Rightmove, Knight Frank, Savills, Acadata & more…

‘Storm clouds clearly visible’, warns the RICS as ‘dial shifts’ on the housing market

The property market 'has clearly shifted in a negative direction', says the RICS' Chief Economist, with surveyors expecting house prices and transaction volumes to fall in the coming months.

Most home-buyers & sellers ‘remain undeterred’ by property market turbulence

One in six home-movers have changed plans as a result of recent mortgage market catastrophising, according to a London estate agency's latest survey, but the majority of buyers and sellers remain 'level…

Race for space is over, says buying agency

Black Brick has been 'inundated' with requests for classic two-bed flats around Hyde Park - and buyers aren't even asking about a garden or balcony...

House price growth was running at 9.8% across England & Wales last month – Acadata

The market was outperforming expectations before the Chancellor's mini-Budget, with annual inflation of up to 25% recorded in some parts of the country.