Policy

UK property tax regime is ‘second worst’ in the world

American think tank's analysis prompts fresh calls for the abolition of Stamp Duty.

Tom Bill: Lower borrowing costs offer respite for the Treasury & mortgage holders

Falling gilt yields may give the government more breathing room but possibly not enough to prevent new property taxes in next month’s Budget, explains Knight Frank's head of UK resi research.

London’s resi planning rules ‘set to be eased under emergency provisions’

Mayor Sadiq Khan & Housing Minister Steve Reed are said to be discussing a temporary relaxation of regulations in the capital.

No such thing as bad publicity: On navigating negativity, noise & nuance in Prime London’s property market

Beyond the algorithm-driven echo chambers, prime buyers remain focused on quality and long-term value, report Richard & Sophie Rogerson.

Last-minute planning reform updates aim to thwart local ‘blockers’

Government says it is 'serious about cutting red tape to get Britain building again,' unveiling new call-in powers & a 'helping hand' for developments mired in legal reviews.

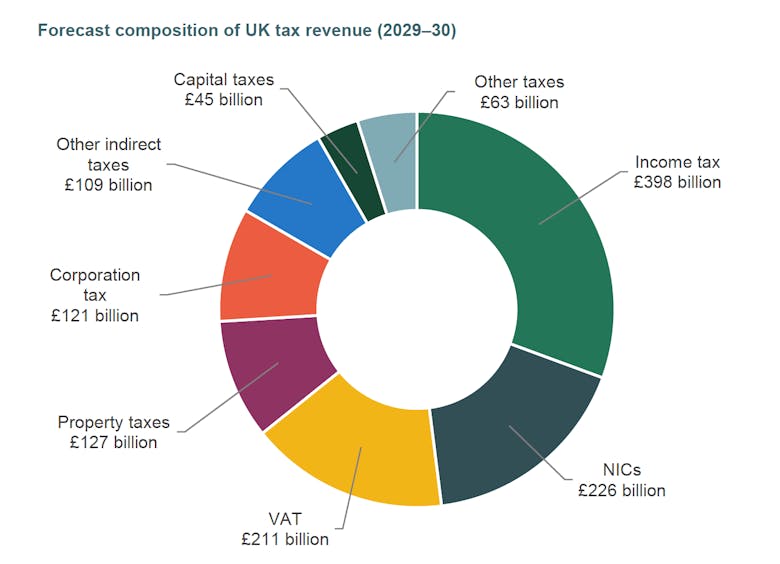

Stamp Duty ‘should be abolished as part of a wholesale reform of property taxation’

'SDLT certainly should not be increased,' declares an in-depth new report by the Institute for Fiscal Studies, and 'a well-designed tax system would have no place for SDLT at all.'

Abrahmsohn: Will we see a Christmas bonus for agents after the Budget?

Late November & December are notoriously tricky trading months - but this year could be different if Rachel Reeves decides to ditch the dreaded SDLT, writes the Glentree boss.

Property industry reactions: Tories pledge to ‘abolish’ Stamp Duty

Stamp Duty is 'a bad tax, an un-Conservative tax', says Kemi Badenoch.

Government proposes the ‘biggest shakeup to the homebuying system in this country’s history’

Consultations have opened into significant & wide-ranging reforms that promise to 'rewire a chaotic system which has become a barrier to homeownership.'

OnTheMarket: Consumer confidence in UK housing market ‘remains robust’

Despite ongoing economic uncertainty, the property portal's latest sentiment index finds buyers, sellers and renters in upbeat mood - though many doubt the government will meet its housing goals.

Influential committee calls for ‘major reform of the whole property tax system’

'The case for major reform of the whole property tax system – from Stamp Duty Land Tax to Inheritance Tax to Council Tax and VAT – is almost unarguable,' says Sir Vince Cable.

Council Tax revaluation ‘not on our agenda’, says Housing Secretary

Reports suggest one of the many rumoured November tax hikes is not under real consideration by the Treasury.