The Market

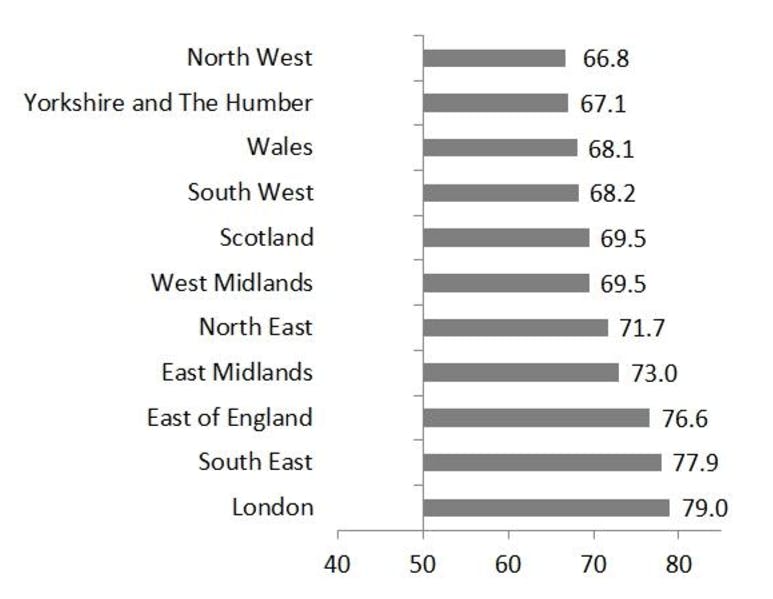

UK housing stock now worth £5.2 trillion as North-South tilt steepens

The total value of the UK's housing stock rose by £186bn in 2013 to hit £5.2tr, according to some (big) number crunching by Savills, and by £1.6tr over the last decade from £3.6tr in 2003.

Edinburgh signals return to normality as transaction levels rocket

Fair Edinburgh has seen a return to "normal, healthy transaction levels", according to the Knight Frank team after they recorded a whopping increase in Q4 deals.

Call To Farms: Buying and developing agricultural land for residential use

We all know it's been a shrewd investment in recent years, but just how easy - or sensible - is it to buy up and develop farmland?

Goodbye “hotel chic” and other trends for 2014

There'll probably be fewer foreign buyers, dull design schemes and 60s mansards this year, says James Bailey...

Happy Place: More signs of high homeowner confidence

Countrywide's latest YouGov sentiment survey comes to a very similar conclusion to Knight Frank's version released last week: we're all pretty positive about house prices.

HIP Hop: RICS recommends Home Reports for England & Wales

An independent inquiry, commissioned by the Royal Institute of Chartered Surveyors, has suggested that Home Reports - which sound rather similar to the much-maligned Home Information Packs that were ditched…

Supply problem has been 40 years in the making – Hamptons

Any recent property market report will - more likely than not - include the phrase "chronic supply shortage".

Mayfair “outranks” Knightsbridge as London’s top luxury address – Wetherell

The Mayfair corner's come out swinging with some statistical gymnastics to counter Nick Candy's claim that W1's oversupplied and due for a price drop this year (as reported here).

N.B.

Homeowner hopes hit another record high

Knight Frank's latest Future House Price Sentiment Index has hit a brand new high, with homeowners expecting prices to rise at the fastest rate since 2009, when the index started, and households in every…

Flood insurance deal will cover domestic properties “regardless of whether leasehold or freehold” – ABI

The Association of British Insurers has rebutted yesterday's claims that proposals set out to provide affordable flood insurance will leave leasehold properties, council homes and the entire rented sector…

Price rises spread beyond the commuter zone

The much-touted "ripple effect" looks to be well and truly underway in the south of England, with Savills recording a 1.5% uplift in average prime regional values in the three months to December.

Young professionals “defining” London’s housing market

Want to know where prices are going to rocket over the next ten years? Going by Winkworth's latest research, you should probably start by finding out where the youngsters are living right now...

Uber-priced?