The Market

Annual sales up 32%, average £psf up 13% & South London outperforms – Lonres

The definitive quarterly roundup of goings-on in the London property market - the Lonres Winter Review - will be landing on desks with a reassuring thump over the next few days.

Should we restrict overseas investors buying up UK homes?

Last week, a leading think tank pitched the idea of setting up a “non-resident housing investment agency” to limit property purchases by wealthy foreign buyers and keep a lid on the capital’s house…

“Jackpot time” for vendors as 23 buyers vie for each home – Marsh & Parsons

Prime London's property market is kicking right off, with Marsh & Parsons reporting that just shy of half (48%) its properties sold for or in excess of asking price in January, and that over a third (34%)…

Didn’t See That Coming: 2013 Forecasts in Review

The Lonres Quarterly Review has delivered again, with a smorgasboard of stats, insight and trends from the last three months and beyond.

Scottish prime’s “gentle recovery”

"There are signs of a gentle recovery at the top end of the Scottish market," says Savills, as the volume of £1m+ sales begins to pick up and values nudge upwards. Prime Scottish prices rose by 1.

Boles swipes at office-to-resi naysayers

Planning Minister Nick Boles has comes out swinging against local authorities that have "an irrational objection" to office-to-resi permitted development rights.

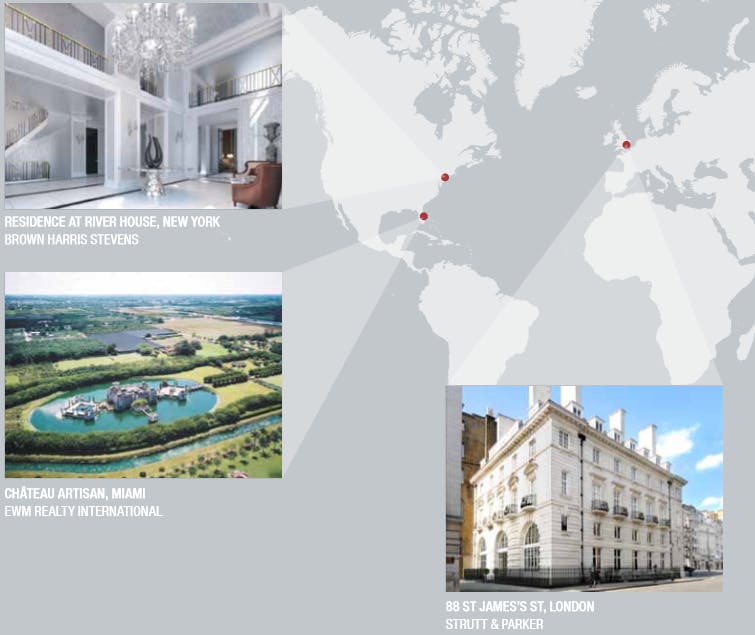

“Exceptionally strong” luxury property sales volumes in London, Miami and New York

"The story for 2013 is about sales volume, not pricing growth," says a new report from Christie's International Real Estate and Strutt & Parker, as median prices in three of the world's top luxury destinations…

PCL rents finally on the rise as economy rebounds

Prime central London rents rose for the first time in 21 months in January, according to Knight Frank.

It was only a 0.2% increase, but that's still the biggest since September 2011.

Brace of record penthouse sales for Aston Chase

North London agency Aston Chase has been having a cracking start to the year, tucking away two record-breaking penthouse apartments in St John's Wood within a couple of days of each other.

New Resi Investment Director for Chesterton Humberts

Chesterton Humberts has appointed Paul Belson as its new Residential Investment Director.

Curb Appeal: Think tank calls for restrictions on overseas buyers

A leading think tank has pitched the idea of setting up a "non-resident housing investment agency" to limit property purchases by wealthy foreign buyers and keep a lid on the capital's house prices.

Should we be applying punitive taxes to empty homes?

Rather than complaining and propagating the confiscation of empty homes, commentators should be applying their energies to making the planning process efficient, less political and more productive, says…