The Market

Ranked Outsiders: Estate agency league table launches

A league table of local estate agents' performance has been launched to 'help property owners make an informed decision' and drive business for local independents with skinny marketing budgets.

Required Reading: Second home ownership and the EU’s new succession rules

Ten years in the making, a fundamental shift to succession rules in most EU countries will come into force next year.

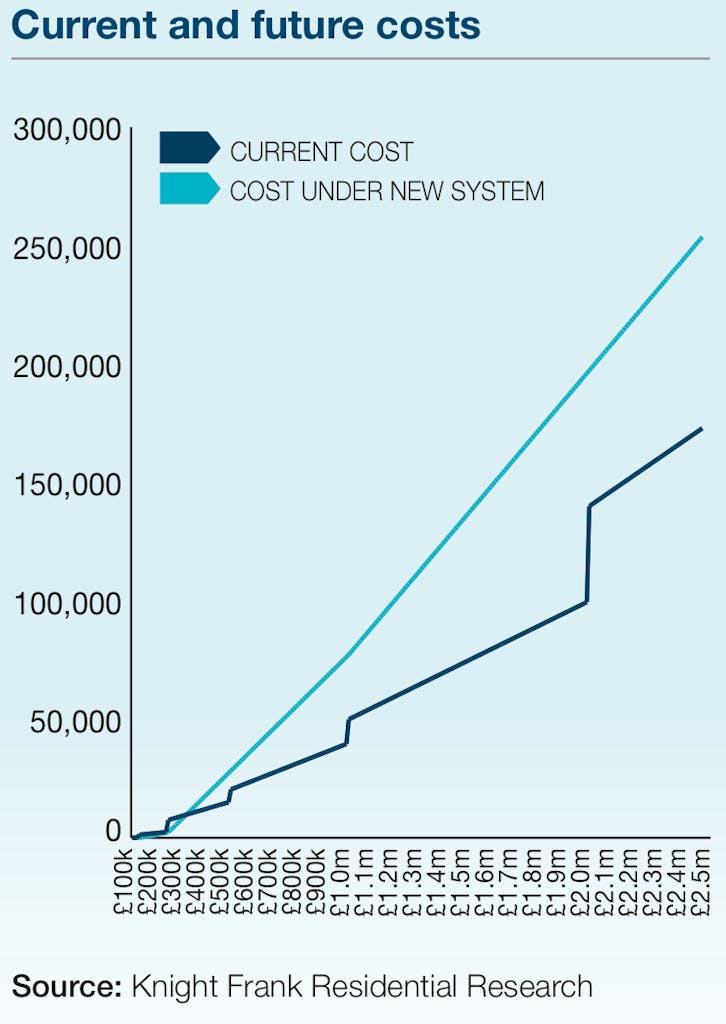

Entry-level mansion-dwellers would pay £250 per month – Balls

Ed Balls has detailed just how Labour's Mansion Tax would work, should the party get lucky in May.

FORECAST: +5% for UK house prices next year, but only +2% for PCL – Strutt & Parker

Strutt & Parker is more optimistic than Knight Frank about what 2015 holds in store for the UK's property market, but there's not much in it.

FORECAST: PCL values to double over the next ten years – D&G

There's value in prime central London's £2m-£4m bracket if you take a longer term view, says D&G Asset Management.

Be Careful What You Wish For: The reality of a ‘dampened’ property market

With Carney in a bugger's muddle over interest rates, let's hope 'the medicine does not kill the patient’, says Trevor Abrahmsohn...

I despair.

Capco’s Covent Garden prime rental play

Capco has made its first foray into the luxury rental market in Covent Garden, with a new scheme on Southampton Street.

Housing market is ‘not going to be back to normal until the end of the decade’

London's housing landscape is "not going to be back to normal until the end of the decade," argued a top housing professor yesterday.

Demand rises but prices hold in prime Scotland

No change for prime Scottish country house prices last month, leaving annual growth down to it's lowest level of the year, +1.4%, according to the latest from Knight Frank.

Henry VIII’s palatial Surrey tower looks for a new tenant

The only surviving remnant of the Royal Palace of Esher has become available to rent for £15k a month.

BoJo: We can deliver 500,000 new homes for London within the next ten years

Boris Johnson has kicked off the inaugural MIPIM UK conference with a rabble-rousing keynote speech, criticising the 'xenophobic left-wing commentators' calling for a clampdown on overseas investment.

Former Aylesford boss launches independent prime agency

Louise Hewlett has just launched an independent property company