The Market

Resi development land values moderate as developers become ‘more selective’

The rate of growth in residential development land values is easing up, says Knight Frank, dropping from +5.6% in Q2 to +3.7% in Q3.

Development land prices rose by a paltry 0.

‘Encouragingly strong’ Phase 3 sales at Battersea Power Station (and one very famous buyer)

It's been an 'encouragingly strong' week of sales down at Battersea Power Station, after another swathe of apartments were made available to pre-registered and existing buyers in London.

Carrington: It could be a long winter for the resi sales market

Currently, none of the main political parties have a coherent strategy, and this uncertainty is not helping the market at all, says Lonres Chairman William Carrington...

Chelsea Vs Pimlico: Half the price or double the value?

Despite counting Westminster Abbey and Tate Britain amongst its local amenities, Pimlico remains very much in the shadow of its more fashionable neighbours.

Demand from overseas buyers plummets across prime central London

The latest Lonres Survey of Agents - essential reading for anyone with even a passing interest in prime property - has confirmed the slowdown in central London's resi sales market since the beginning…

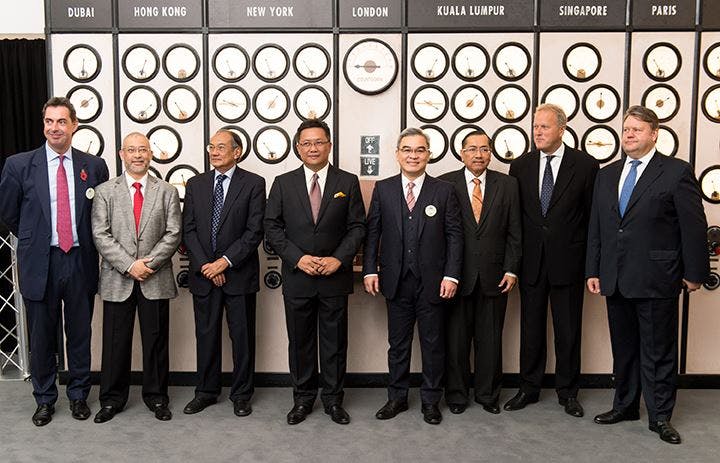

Buyers Without Borders: Overseas buyers in the London market

Overseas buyers have always played a significant role in the London real estate market, says CBRE in its Global Living Report, although it's not just a British phenomenon.

Record Q3 for UK auction houses (and a passageway goes for £260k)

The number of lots sold at auction across the UK during Q3 was the highest ever recorded by data firm EIG.

£11,400-a-minute: How commuting time affects house prices

An extra minute on a commute knocks £11,400 off the value of a property, according to (more) research from CBRE.

Cash In The Attic: Converting this unmod roof space in South Ken ‘could add another £1.55m’

Billed as a 'Grand Designs-style opportunity', an unusual instruction has just hit the market in South Kensington complete with one of the most sought-after features in London...a massive attic.

Behind the Stats: What’s really happening in the PCL market?

"The furore about a possible house price bubble over recent months ...

Have we fallen out of love with the prime country house?

Clients selling a 3,500 square foot Kensington townhouse could almost afford to buy two Georgian rectories at the moment, but there remains a reluctance for many to make that move out to the country, says Haringtons'…

The Cost of Prime: London tops prime new-build price league

London is the most expensive city in the world for prime resi, says CBRE, with average prime new build prices now standing at £2,000 per square foot.