The Market

CEBR revises forecasts after SDLT reform: London prices to fall by 3.3% this year

The Centre for Economics and Business Research has slightly amended its house price forecasts for the coming year, now arguing for a smaller 0.6% drop in the national average price rather than the -0.

Double digit growth for residential auction action

The number of residential lots offered and sold at auction didn't move by a huge amount last year, but the value raised by the gavel soared by over 14%.

The quantity of lots nudged up by 1.

Hurford Salvi Carr sells £12m Tech City apartment block

Hurford Salvi Carr had a busy festive season, what with opening a new branch on City Road and shifting this freehold monster by Silicon Roundabout.

Burj Khalifa penthouse sale named as Dubai’s deal of the year

It's been confirmed that an apartment in the world's tallest tower was the biggest sale to go down in Dubai last year.

According to data compiled by Reidin.

New York & London prime rents tipped to outperform in 2015

A sluggish global economy kept a lid on prime rents around the world last year, but New York and London should see values rise in 2015, according to Knight Frank's latest check.

The Return of the Gazunder: London’s new market paradigm

There's a "new paradigm" in the London market, notes Douglas & Gordon, after supply levels charged by 60% over the last year while demand slipped by 30%.

New price record for Belgravia as £46m Chesham Place deal goes public

One of the biggest deals in the capital last year has come to light after cropping up on Land Registry records.

Jailhouse Stock: New gaols for City & Country

The specialist heritage developer behind last year's dramatic £25m swoop on the former Police College at Bramshill has been confirmed as the buyer of four historic former prisons across the UK.

D&G boss rails against ‘ill-informed guff’ surrounding OnTheMarket launch

Ed Mead of independent agency Douglas & Gordon reckons there's rather a lot of "guff" being pedalled about the impending launch of OnTheMarket.

Bulgari penthouse sale crowns £120m year for VanHan

VanHan - Thomas van Straubenzee and Rory Penn's super-prime advisory firm - had a particularly strong 2014 by all accounts;

‘Terrifying’ Redrow promo video causes a stir

National housebuilders aren't known for pushing the boundaries - in an arty sense anyway - but a marketing video for Redrow's new London Collection has got tongues wagging all over the internet for…

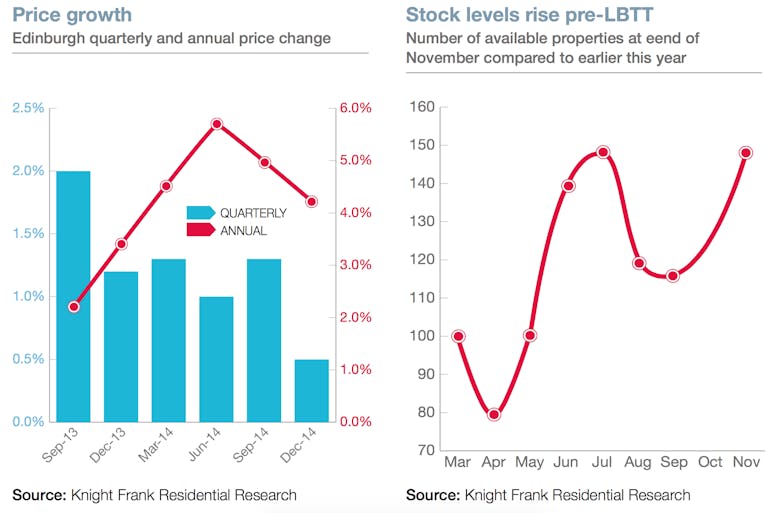

Prime Scottish market rallies to beat proposed tax hike

A strong finish to 2014 for Scottish prime property, as prices rose by 1% during the fourth quarter to take annual growth to +2.1%, says Knight Frank.

That's a bit better than 2013's +1.