The Market

Fringe Benefits: Emerging Prime London outperforms Prime for third year running

Emerging Prime areas in SW London continue to drive some of the best returns on investment, according to Douglas & Gordon, outstripping PCL for the third year on the bounce.

London homeowners expect prices to rise by 9% in the next six months – Zoopla

It turns out that homeowners are a tad more bullish than most paid property pundits: Zoopla's latest sentiment survey estimates that people across the country think the value of their homes will rise by…

INTERVIEW: Mark Collins on how CBRE became a resi force to be reckoned with

The man behind CBRE's meteoric rise into the resi big league, Chairman of Residential Mark Collins discusses his ambitions for the business, the most undervalued parts of PCL, and the boutique developers…

Buyers and investors should take advantage of this window of opportunity – Winkworth

2015 is shaping up to be a "challenging" year, says Winkworth, but the agency's PCL teams have nonetheless turned in an "encouraging" January, with decent levels of stock and signs of "more sustainable" price…

£1m+ sales jump by 15% – Land Reg

The average house price across England and Wales nudged up by 0.6% in December to take the annual rate growth to 6%, according to the latest batch of data from the Land Registry.

How the iceberg home melted away

Homeowners and developers should still be able to build good-sized subterranean extensions, but the days of the mega-basement are dead and buried, says Ed White...

Doing a Grosvenor: The Making of Mayfair’s Mount Street

How do you reposition a sleepy backwater into one of the world's top luxury destinations?

Southbank’s Palace View site comes to market

A few days after Alchemi announced the sale of its 300,000 square foot scheme in Victoria, another prominent development site has just hit the market in the capital, this time on the Southbank.

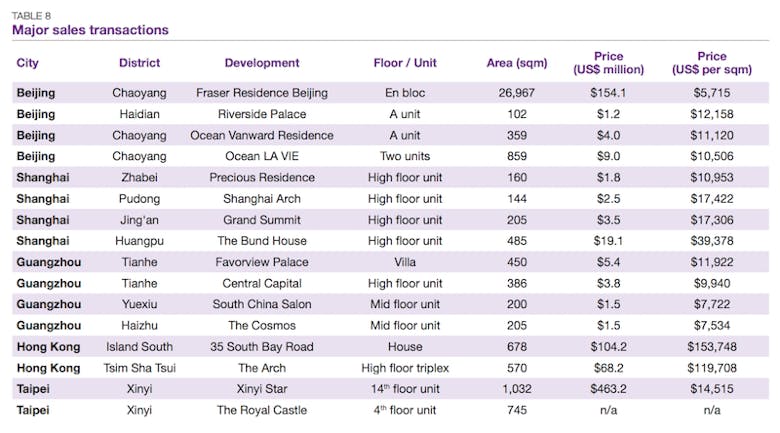

Favourable policies boost China’s luxury resi market

Mainland China's luxury resi market is set to experience another wave of increases in terms of both prices and sales volumes in 2015, Knight Frank has said.

Oil prices and Eurozone easing could ‘pop London’s property bubble’

Quantitive Easing in Europe and crashing oil prices could cause central London's property prices to drop by "as much as 50%" warn a couple of people in MoneyWeek.

‘No easier’ to buy a PCL pied-a-terre in 2015 than it was in 2014

The Midtown, City and Docklands patch has witnessed some pretty interesting trends over the last year, reports local agent Hurford Salvi Carr, including pied-a-terres becoming flavour of the month...

Pretty Vacant: Why Tessa Jowell’s plan to tax empty homes is doomed to fail

The reason why private landowners keep derelict houses empty is usually because they are waiting for a planning resolution, says Trevor Abrahmsohn...