The Market

Maskells boosts sales arm with two senior hires

One of the oldest independent agencies operating in prime central London, Maskells, has significantly bolstered its sales operation with two big appointments.

Howard Elston

Emerging prime prices slip as all goes quiet on the South-Western front

Stamp duty acclimatisation and interest rate expectations have quelled activity in London's emerging prime regions over the last year, says Douglas & Gordon: the firm's Emerging Prime Index shows property…

Grosvenor offers two Mayfair blocks for £120m

Grosvenor has put the long leases of two super-prime residential developments in the heart of Mayfair up for sale for £120m.

Rock star rallies against ‘basement-building b*******’

Badger-sympathising rock legend Brian May has reportedly co-founded a campaign to put the kibosh on "destructive" subterranean extensions in central London.

London is the world’s most expensive city to live/work – Savills

London trumps Hong Kong and New York for the dubious honour of being the most expensive world city to live and work in, with a price per head for renting residential space plus working space coming in…

First Look: Wilben’s new £32.5m townhouse on Chester Square

The boutique development firm set up by twin brothers William and Benjamin Samuels has just put the finishing touches to its most ambitious project to date - an absolute belter in one of the best bits of…

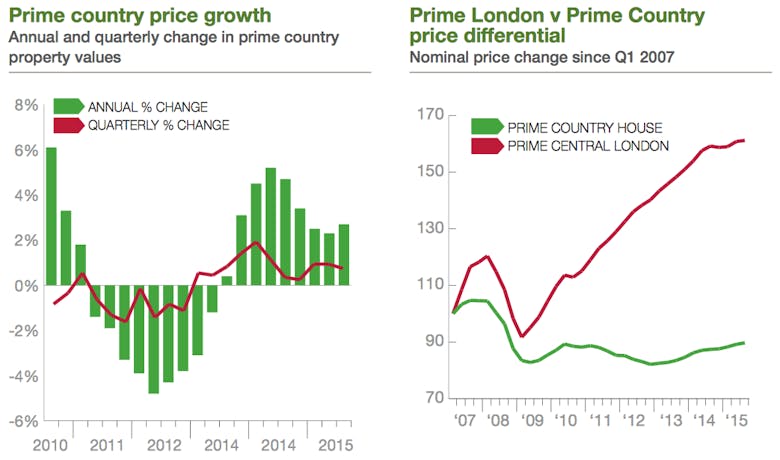

Prime country house prices nudge up again, but the top-end is still stamped-on

Prime country house prices nosed up by 0.7% in the third quarter of 2015, taking annual price growth to +2.7%.

Annual price growth stands up from +2.

Bricks & Mortals: What does ‘safe’ mean in the London property market today?

When it comes to investing in the capital's property market, the term 'safe' has taken on a very different meaning in recent years;

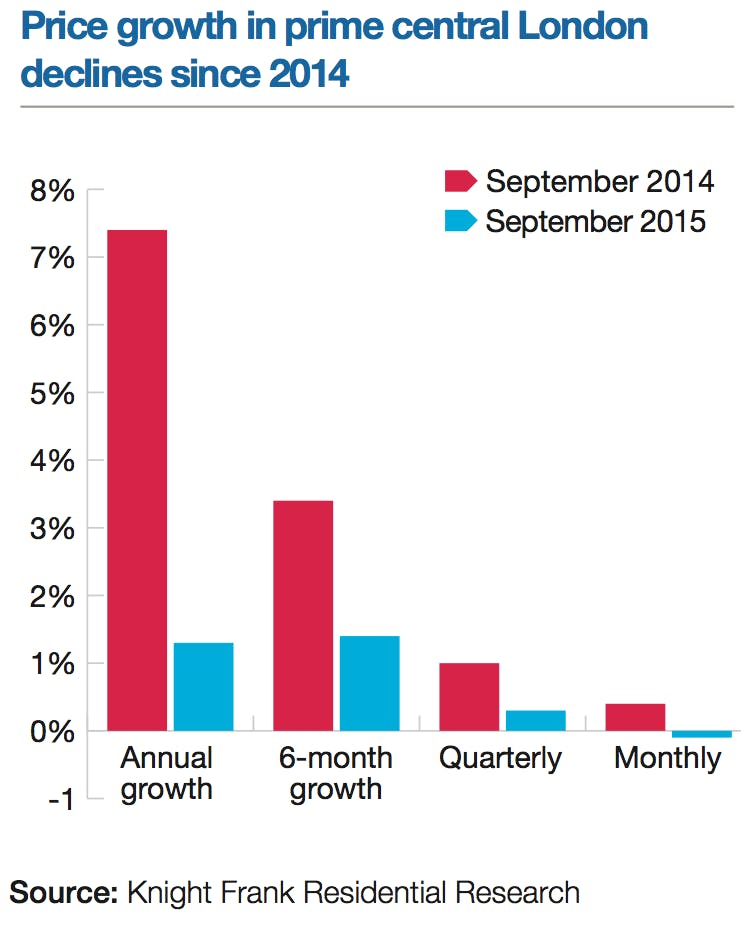

‘Flight to quality’ in divided PCL as buyers stay cautious

The prime central London market changed up a gear in September, says Knight Frank, but performance has varied dramatically across town and we're still some way off a full-blown recovery.

Surrey agency goes interactive with ‘intelligent’ window

A Surrey estate agency has installed a neat gizmo in its high street branch to harvest applicants 24/7.

Golden Ticket: Prize Soho block goes for £43m

A key building on Soho's Golden Square has been snapped up by a resi developer for a cool £43.02m.

Superprime Cybercrime: Avoiding and dealing with property transaction scams

Increasingly sophisticated methods of cybercrime are causing havoc for property investors and law firms, with conveyancing firms proving particularly vulnerable.